Why Smart Money Is Piling Into the Beatty Gold District — And Augusta Gold (TSX: G) Is First in Line

Published: April 8, 2025 at 8:30 PM ET | G Price at Publication: $0.89/share

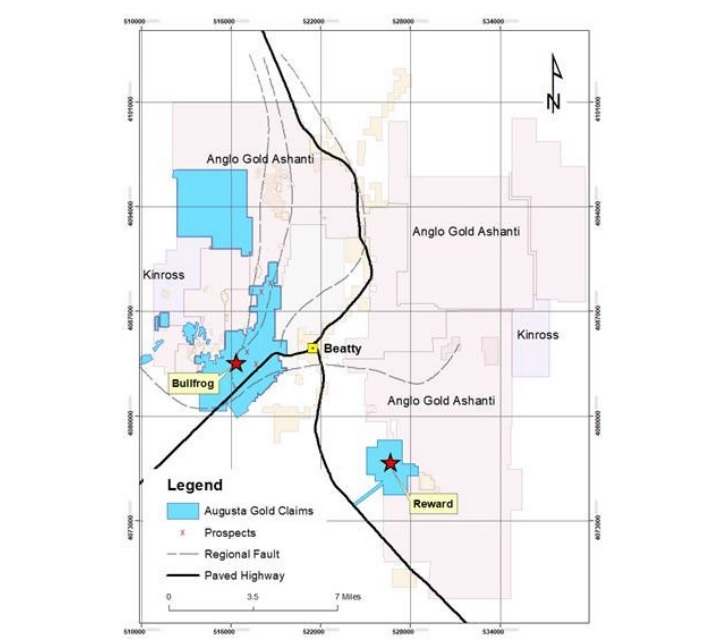

Augusta Gold Corp. (TSX: G) is at the forefront of the Beatty Gold District in Nevada, alongside AngloGold Ashanti (NYSE: AU), one of the largest gold producers in the world. Together, they are shaping what could become North America’s most prolific new gold mining region.

The Beatty Gold Boom

AngloGold Ashanti (NYSE: AU) has been rapidly consolidating the Beatty Gold District and has already spent US$600 million in cash just to acquire the North Bullfrog gold project (adjacent to Augusta Gold's Bullfrog gold project) and Sterling gold project (adjacent to Augusta Gold's Reward gold project). AngloGold Ashanti's Beatty gold resource base includes:

- Silicon: 3.4Moz M&I (brand new gold discovery)

- Merlin: 12.1Moz Inferred (brand new gold discovery largest U.S. gold discovery in 15+ years)

- Silicon+Merlin combined = Expanded Silicon gold project aka Arthur gold project (AngloGold renamed to Arthur this month)

- Reserves: 370,000 oz Au at 0.86 g/t

- Feasibility Study: Avg. 39,000 oz/year for 7.6 years

- NPV (at $3,200 Au): US$273.3M

- Status: Fully permitted and construction-ready

- Resources: 1.2Moz Au M&I at 0.53 g/t, 258koz Inferred

- Past Production: 2.3Moz Au

- Production Potential: 110,000 oz/year by 2027 and 150,000 oz/year Combined Reward+Bullfrog

- Gold above $3,000/oz (and trending towards $4,000) make Reward and Bullfrog extremely economic

- AngloGold says they are targeting 300,000 oz per year of production in the Beatty District but they want to produce much more and will need Augusta Gold's assets

- With Augusta’s Reward and Bullfrog, Beatty's production could exceed 450,000 oz per year

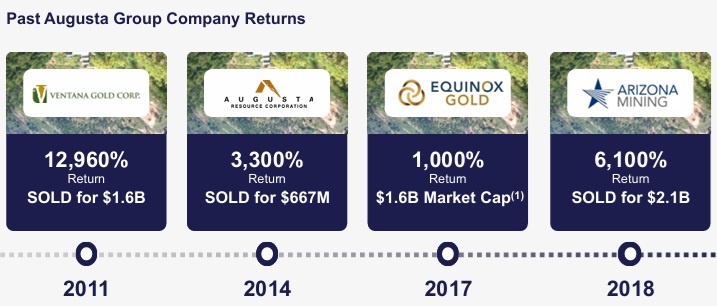

Track Record of Extraordinary Value Creation

The Augusta Group has an unmatched history of delivering extraordinary shareholder returns through disciplined exploration, development, and strategic exits in the mining sector. Since 2011, Augusta-backed companies have generated some of the highest realized returns in the industry. Notable successes include Ventana Gold acquired for $1.6 billion after a gain of 12,960%, Augusta Resource Corporation acquired for $667 million after a gain of 3,300%, Equinox Gold achieving a gain of 1,000% prior to listing in 2017 with a $1.6 billion market cap, and Arizona Mining acquired for $2.1 billion after a gain of 6,100%.

In July 2020, the Augusta Group launched Solaris Resources (TSX: SLS) as a strategic spin-off from Equinox Gold, unlocking the full value of its flagship Warintza Project in southeastern Ecuador. Solaris quickly captured the attention of the global mining investment community, surging by 1,144% within just 18 months of its listing.

Triple Flag’s April 2025 Acquisition of Orogen Royalties Valued Orogen’s 1% NSR in Expanded Silicon at US$250 Million Making it the Most Expensive 1% NSR Royalty in Gold Mining History

The largest 1% Net Smelter Return (NSR) royalty transaction in gold mining history is the recent acquisition by Triple Flag Precious Metals (TFPM) of Orogen Royalties' 1.0% NSR royalty in the Expanded Silicon aka Arthur gold project. This deal, announced in April 2025, was valued at approximately US$310 million and valued the 1% NSR royalty in Expanded Silicon aka Arthur at US$250 million. This makes the Expanded Silicon aka Arthur gold project worth an estimated US$5 billion, and it is directly adjacent to Augusta Gold's Reward and Bullfrog gold projects.

Augusta Gold’s Edge: First Mover Advantage

Augusta Gold's Reward is a fully permitted gold project ready for immediate construction. With its perfect location in the largest and most valuable newly discovered U.S. gold district and low CAPEX, Reward is likely to become the Beatty District’s first modern day producing gold mine.

Reward Project Highlights

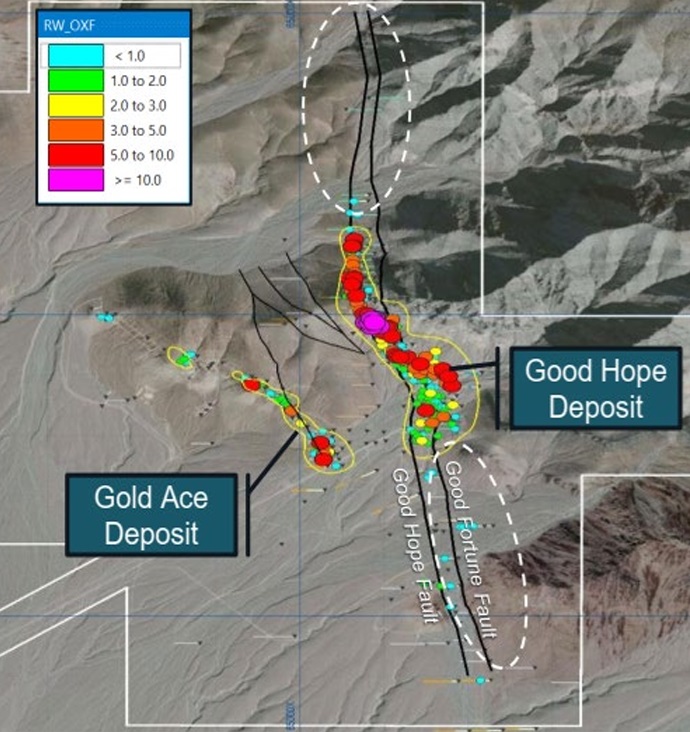

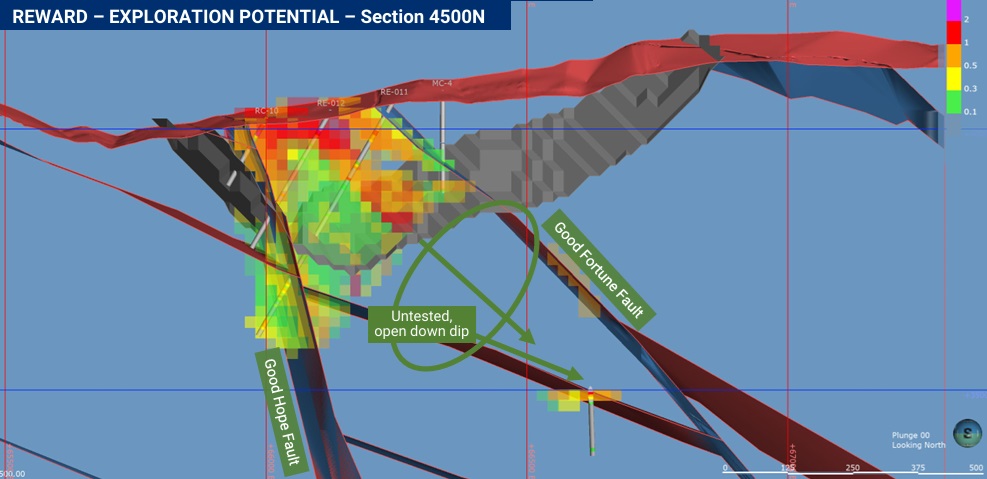

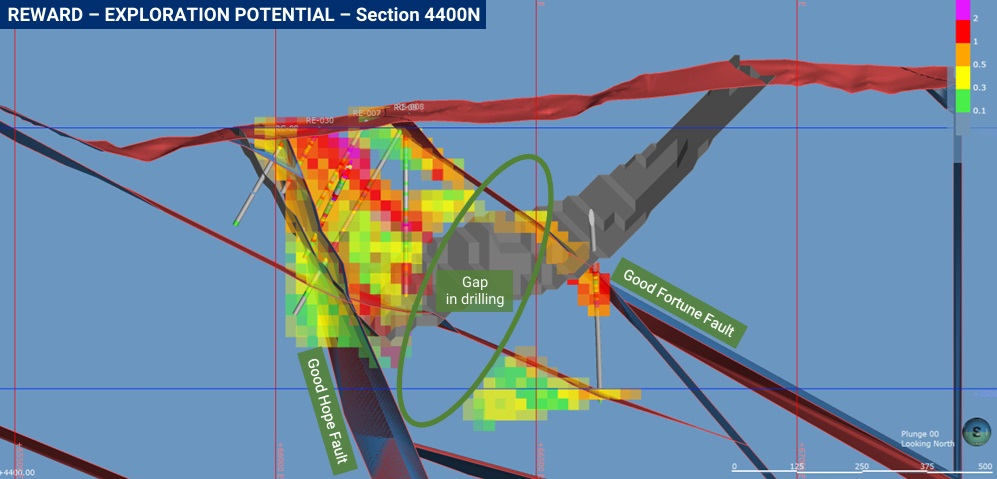

Reward remains wide open for significant gold resource expansion. With large areas of known mineralization — especially north and south of the Good Hope Deposit — still untested, the potential to meaningfully grow Reward's gold resource base is substantial.

Recent drilling along the Good Fortune Fault intersected strong mineralization in areas that were previously overlooked, confirming the system’s strength and continuity.

Future gold resource expansion drilling could be done by either Augusta Gold itself or by a major gold miner that acquires the company.

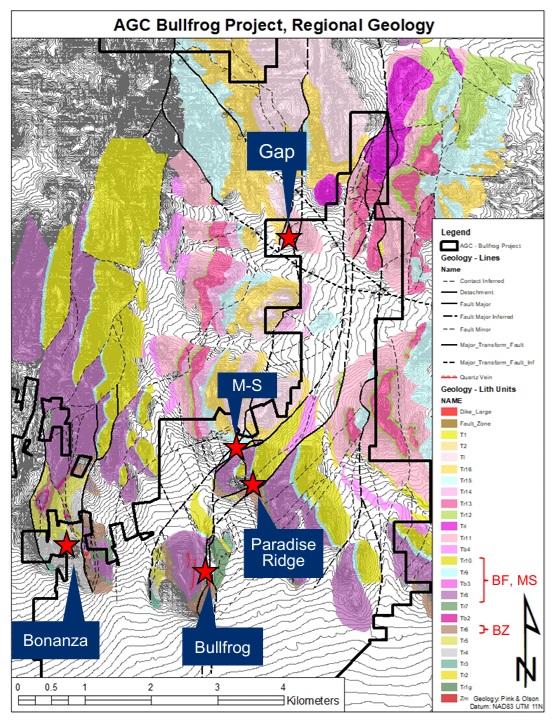

The Bullfrog Advantage

Located just 4 miles from Beatty, Nevada, Augusta Gold's Bullfrog gold project previously owned and operated by Barrick Gold produced approximately 1.02% of all historical gold production in Nevada.

Bullfrog Project Snapshot

Synergies Make Augusta Gold a Takeover Target

Augusta Gold’s proximity to AngloGold Ashanti's Expanded Silicon aka Arthur gold project makes it a takeover target. AngloGold Ashanti (AU) is the most likely buyer of Augusta Gold (TSX: G), but Kinross Gold (KGC) could also be a potential acquirer of the company. Kinross has a strong operational presence in Nevada and has shown a strong interest in the Beatty District.

Management That Delivers

Augusta Gold CEO Donald Taylor discovered Arizona Mining's Taylor Deposit leading to a $2.1 billion cash takeover by South32 for 1,576% above NIA's Arizona Mining suggestion price.

Augusta Gold Executive Chairman Richard Warke consistently creates huge returns for investors and has achieved $4.5 billion in exits over the last 15 years.

Former U.S. House Speaker John Boehner is on Augusta Gold's Board of Directors.

Why Now?

With permits in place, construction ready to begin, and a district poised for multi-decade gold production, Augusta Gold (TSX: G) offers investors leverage to America's largest new gold rush.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.