Can NevGold Seriously Outperform TII and TRT?

Many NIA members are asking if we seriously believe NevGold (TSXV: NAU) has potential to outperform our Top 2 picks for 2026: Titan Mining (TII) and Trio-Tech International (TRT).

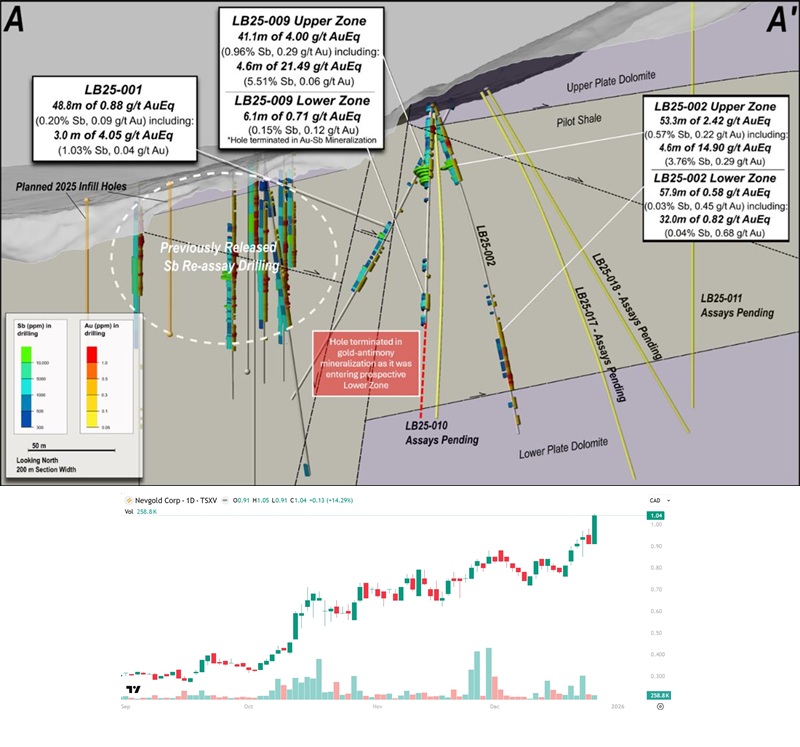

NevGold (TSXV: NAU) has discovered some of the highest antimony grades in U.S. history, and nothing is more important for U.S. homeland security than antimony!

When we posted Eric Sprott's video one week ago, we emphasized in our post, "When discussing Americas Gold and Silver (TSX: USA), Eric did not mention antimony — the primary driver behind its elevated valuation. NevGold (TSXV: NAU) controls what we believe is the best antimony project in the United States and is nearing a maiden U.S. antimony–gold resource. Its market cap is roughly 1/17th of USA."

When we announced we are shorting Hycroft Mining (HYMC) at $30 per share, we also emphasized in that alert, "Sprott’s Americas Gold and Silver (TSX: USA) is already trading for 17x revenue. Come on now! USA is burning massive amounts of cash! The only way to justify USA at 17x revenue is speculation due to antimony. NevGold (TSXV: NAU) has the biggest antimony potential!"

Today, NevGold (TSX: NAU)'s market cap remains very low. NAU gained by 14.29% on Wednesday to a new 52-week high of $1.04 per share, but it still hasn't been discovered as an antimony play!

More drilling results along with NAU's maiden antimony–gold resource estimate are coming soon!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. NIA has received compensation from NAU of US$100,000 cash for a twelve-month marketing contract. Always do your own research and make your own investment decisions. This message is intended for informational and educational purposes only and does not constitute investment advice.