Could FF Gain as Much as Augusta Gold (TSX: G)?

Augusta Gold (TSX: G) has been NIA’s #1 highest confidence stock suggestion that we are 100% sure will gain by 500%-1,000% and we are about to see it happen.

Could First Mining Gold (TSX: FF) gain as much as Augusta Gold (TSX: G)?

Skeena Resources (SKE) filed their final EA for Eskay Creek several months after FF filed its final EA for Springpole and SKE expects EA approval for Eskay Creek in 4Q 2025. SKE is already worth US$350+ per oz of gold resources. FF is currently worth only US$12.77 per oz of gold resources and has much higher odds of receiving EA approval for Springpole this year.

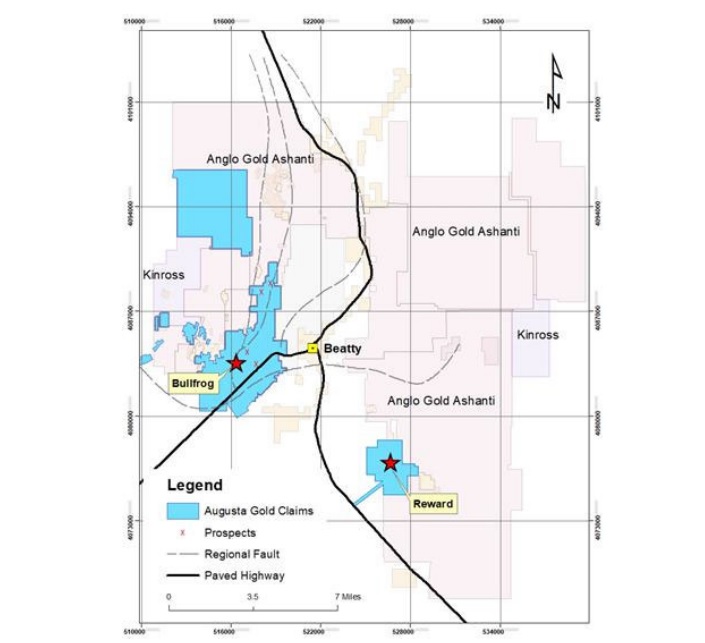

Augusta Gold (TSX: G) Executive Chairman Richard Warke is the most knowledgeable person in the world on SKE’s Eskay Creek but passed on an opportunity to option it from Barrick in favor of acquiring Barrick’s past producing Bullfrog Gold Project and the adjacent fully permitted Reward Gold Project. Even after SKE confirmed that gold resources still remain at Eskay Creek, Barrick didn’t exercise its option to regain a 50% stake and sold all of its SKE shares. Barrick still owns all of its Augusta Gold (TSX: G) shares.

SKE is living off of Eskay Creek’s reputation for producing high-grade gold back in the 1990s. It was Richard Warke and “The Pez” who successfully advanced Eskay Creek and turned it into the world’s #1 highest grade producing gold mine. All of Eskay Creek’s high-grade gold from the 1990s is gone.

Moving forward, the gold mining industry’s #1 biggest story will be the Beatty Gold District, and Augusta Gold (TSX: G) is about to become the first gold producer in the Beatty Gold District.

Richard Warke has made no effort to create hype for Augusta Gold (TSX: G). He quietly executes and builds real companies that get acquired for many billions.

SKE’s Chairman lives in Puerto Rico (always a huge red flag).

Augusta Gold (TSX: G) will become America’s next mid-tier gold producer. Augusta Gold (TSX: G)’s market cap will surpass SKE in the future that is for sure.

Both G and FF will strongly outperform SKE.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 232,200 shares of G and may purchase more shares. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.