Energy Transition Minerals (ASX: ETM): The Most Undervalued Major Rare Earth Asset on Earth

Why ETM’s Kvanefjeld Project Is the West’s #1 Strategic Rare Earth Asset

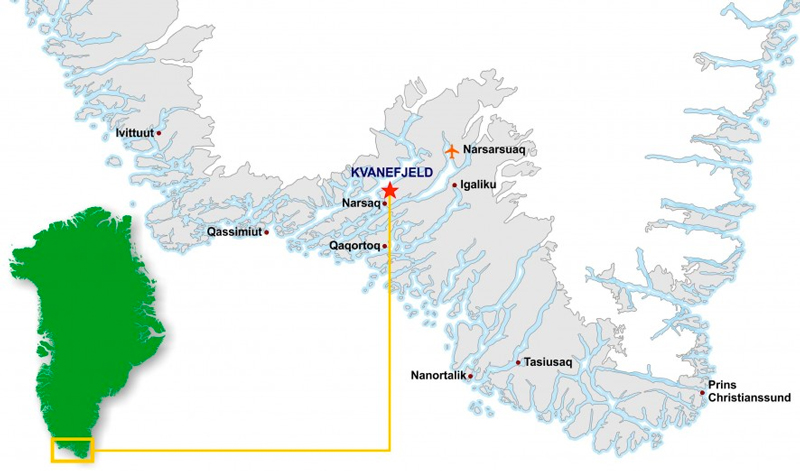

Energy Transition Minerals (ASX: ETM) controls the Kvanefjeld Project, the largest and highest-grade rare earth deposit in the Western world—yet the stock trades at just $0.083 per share, a valuation driven not by geology or economics, but by temporary political conditions in Greenland.

A Tier-1 Rare Earth Asset of Global Strategic Importance

Kvanefjeld hosts:

- 1.01 billion tonnes of ore

- 1.10% TREO grade

- ~11 million tonnes of contained rare earth oxides

This scale positions the project to potentially supply up to 15% of global rare earth demand for multiple decades.

Even more importantly, Kvanefjeld is rich in the four rare earths most critical for permanent magnet manufacturing:

- Neodymium (Nd)

- Praseodymium (Pr)

- Dysprosium (Dy)

- Terbium (Tb)

These metals are essential for EV motors, wind turbines, fighter jets, naval systems, precision-guided munitions, and advanced defense technologies. Few deposits globally match Kvanefjeld’s combination of scale, grade, and magnet-metal richness.

Massive Valuation Disconnect vs. Inferior Peers

If smaller, lower-grade North American projects can command multi-billion-dollar valuations—

- USA Rare Earth (USAR): ~US$4.4 billion

- Critical Metals Corp (CRML): ~US$2.4 billion

—then Energy Transition Minerals at only ~US$106.8 million is easily the most undervalued advanced rare earth company in the world.

The only plausible explanation for this gap is that the market is pricing Kvanefjeld as if it were permanently stranded. That assumption is purely political—and increasingly out of step with reality.

During a January 2025 trip to Nuuk with Donald Trump Jr., Charlie Kirk described Greenland as having:

- “Incredible natural resources” including gold, rubies, oil, natural gas and rare earth minerals.

- A Danish government that “does not allow locals to exploit or use or take advantage of” these resources.

- Locals who “want to be part of America” and “can’t stand Denmark”.

Kirk concluded that bringing Greenland into the U.S. orbit would be “the best investment America could make in my lifetime.”

Geopolitics & Greenland: From Theory to On-the-Ground Reconnaissance

In January 2025, Charlie Kirk flew to Nuuk on “Trump Force One” with Donald Trump Jr. to see Greenland firsthand. He reported:

- Greenlanders wearing MAGA hats and openly expressing that they want to be part of America.

- “Untouched, serene beauty” comparable only to Alaska—but with far greater undeveloped resources.

- “Incredible natural resources” that Greenland’s current rulers in Denmark refuse to allow them to use.

Critically for ETM, Kirk singled out rare earth minerals as one of Greenland’s three defining features—right alongside its beauty and broader natural resource base.

He also emphasized that the Arctic is becoming a major geopolitical theater involving China and Russia, and that control over Greenland has direct national security implications for the United States.

Why Denmark Is Blocking Development (and Why It Matters for ETM)

Kirk was blunt about Denmark’s role:

- He described the current Danish government as preventing Greenlanders from exploiting their own resources.

- He said Denmark is “harming the great people of Nuuk and Greenland” by keeping them dependent and underdeveloped.

- He relayed that young Greenlanders report being mistreated and looked down on when visiting Copenhagen, while Americans treat them with respect and opportunity.

This matches ETM’s reality on the ground: the uranium ban imposed by Greenland’s political framework—influenced by Denmark—has stalled Kvanefjeld despite its overwhelmingly rare earth–dominated value.

- Approximately 80% of Kvanefjeld’s projected value is in high-grade rare earths.

- The uranium component is minor by comparison yet has triggered a blanket development freeze.

- This is a purely political constraint, not a reflection of the project’s technical or economic viability.

If Greenland gains greater autonomy or shifts closer to the U.S. sphere, the uranium ban could be revised or removed—instantly re-rating Kvanefjeld from “stranded” to “strategic priority”.

Trump’s Hemispheric Doctrine: From Congress to Greenland

In March 2025, President Trump told the U.S. Congress:

“One way or the other, we’re going to get Greenland.”

Later, on The Charlie Kirk Show, Kirk described Trump’s broader vision as a doctrine of hemispheric dominance, with Greenland at the center—not just for its oil, rubies, gold, and rare earth minerals, but for its strategic location.

On Glenn Beck’s program, Kirk reinforced that Trump is “absolutely serious” about Greenland, calling the idea of bringing it under U.S. influence a “moonshot”—the kind of long-term, future-focused move that reshapes generations.

He argued that purchasing or integrating Greenland would be:

“The best expenditure of a trillion to a trillion and a half dollars that America could make… a real investment.”

He also noted that Greenland’s own leadership has publicly stated a desire for independence:

- The Greenlandic prime minister has said, “We want our independence… we want to be our own sovereign nation.”

This creates a clear three-step pathway that could unlock ETM’s value:

- Greenland moves toward full autonomy from Denmark.

- Greenland aligns more closely with the U.S. for defense and economic partnership.

- Greenland revises its resource and uranium policies to responsibly develop world-class projects like Kvanefjeld.

Strategic Timeline: From Concept to Imminent Catalyst

- January 2025: Charlie Kirk and Donald Trump Jr. visit Nuuk. Kirk highlights Greenland’s rare earths, Denmark’s blocking of resource development, and local desire for closer ties to America.

- March 2025: Trump tells Congress, “One way or the other, we’re going to get Greenland,” signaling serious intent—not a throwaway line.

- August 2025: On his show, Kirk outlines Trump’s hemispheric doctrine and explicitly ties Greenland’s rare earth minerals and strategic location to that vision.

Across these appearances, the message is consistent: Greenland is central to America’s future control of critical minerals and Arctic security. Kvanefjeld, as one of the world’s largest undeveloped rare earth deposits, becomes a natural focal point of that strategy.

Set Up for a Historic Revaluation

Kvanefjeld is larger, higher grade, richer in magnet metals, and far more advanced than many U.S.-aligned rare earth projects—yet trades at a tiny fraction of their valuations.

If Greenland’s political conditions shift in any meaningful way—through independence, a revised uranium framework, or closer U.S. alignment—ETM could rapidly re-rate to a valuation that exceeds USA Rare Earth and CRML combined.

Kvanefjeld is not just another rare earth deposit—it is a potential cornerstone of a Western-controlled magnet-metal supply chain in the energy transition era.

Energy Transition Minerals (ASX: ETM) therefore represents a rare alignment of:

- World-class geology

- Global strategic importance

- Extreme undervaluation

- A rapidly evolving geopolitical catalyst

Once political conditions normalize or shift in Greenland’s favor, ETM is positioned for one of the most dramatic re-ratings in the entire critical-minerals sector.

Past performance is not an indicator of future returns. NIA is not an investment advisor. Always do your own research. NIA’s President has purchased 1,300,000 shares of ETM and can buy or sell shares at any time. This message is for informational and educational purposes only.