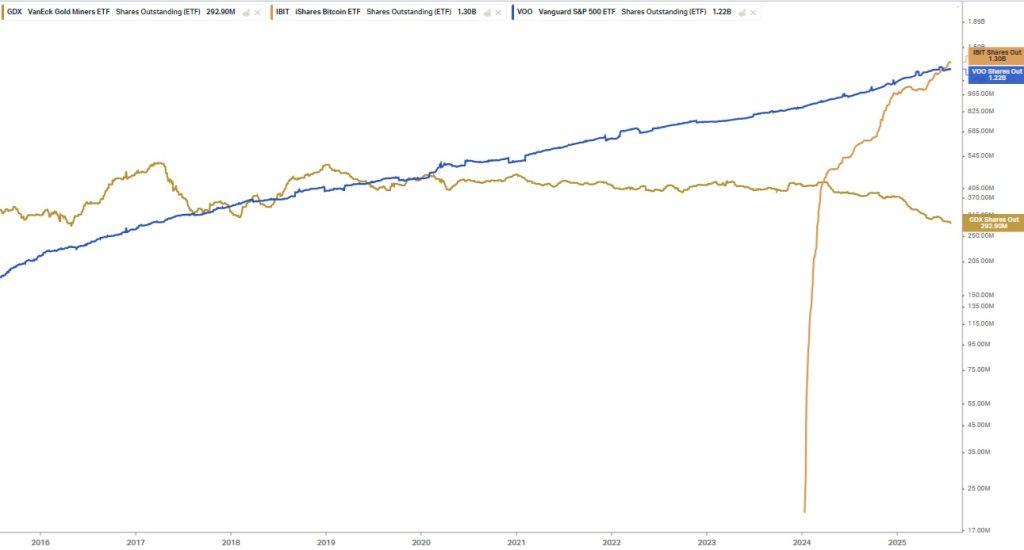

GDX Outflows Continue as Investors Pile into IBIT and VOO

VanEck Gold Miners ETF (GDX) has seen 2025 year-to-date outflows of $3.594 billion alongside a 2025 year-to-date gain of 60.38%.

iShares Bitcoin Trust ETF (IBIT) has seen 2025 year-to-date inflows of $19.967 billion alongside a 2025 year-to-date gain of 25.09%.

Vanguard S&P 500 ETF (VOO) has seen 2025 year-to-date inflows of $72.212 billion alongside a 2025 year-to-date gain of 8.68%.

Bitcoin and the S&P 500 are rising because of inflows into IBIT and VOO. When these inflows become outflows, Bitcoin will decline by 70%-90% and the S&P 500 will decline by 50%-70%.

Gold Miners are rising despite record outflows from GDX. The big move for gold miners and especially gold explorers hasn’t yet begun. GDX ownership is at a new 9-year low and can only improve from here.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.