Most Important Companies to Research Right Now

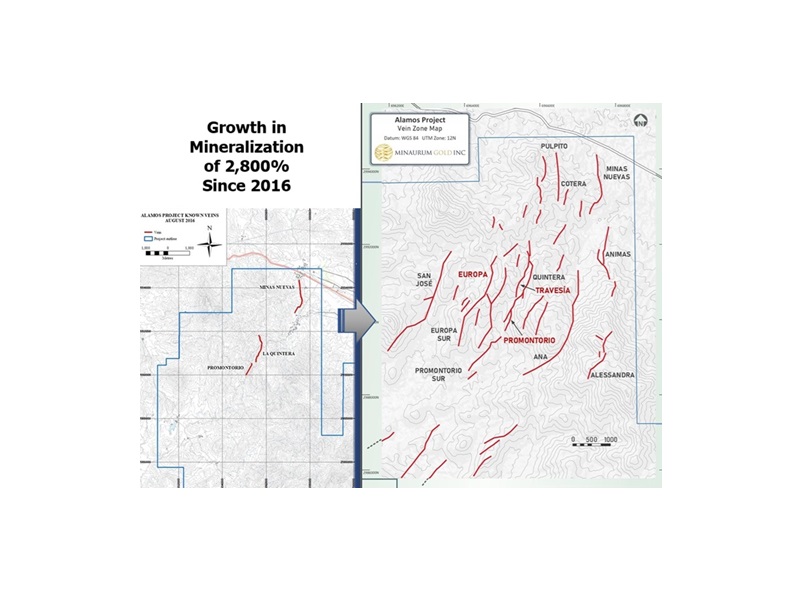

The chart of Minaurum Gold (TSXV: MGG) is finally breaking out after months of trading sideways similar to Highlander Silver (TSXV: HSLV) when we first suggested it on February 12th at $1.40 per share. Remember that Robert Friedland invested into Power Metallic Mines (TSXV: PNPN) months after our initial suggestion and he paid higher share prices. J David Lowell the GOAT of mine finding having supported MGG is much more important to us than any billionaire supporting it. Both HSLV and MGG remind us of an early Solaris Resources (TSX: SLS) in mid-2020.

Eric Sprott is beginning to cash out of Discovery Silver (TSX: DSV) mainly because it became a huge part of his portfolio and it’s better to diversify. DSV has become NIA’s 17th largest gaining stock of all-time dating back to when we suggested Levon Resources. Eric Sprott still owns all of his HSLV and Heliostar Metals (TSXV: HSTR).

Although it’s true NIA’s Contango Ore (CTGO) is generating 5.932x higher free cash flow than HSTR, keep in mind that HSTR’s most important project Ana Paula isn’t being developed yet and HSTR will have more Ana Paula drilling results later this month! A development decision for Ana Paula is coming next year!

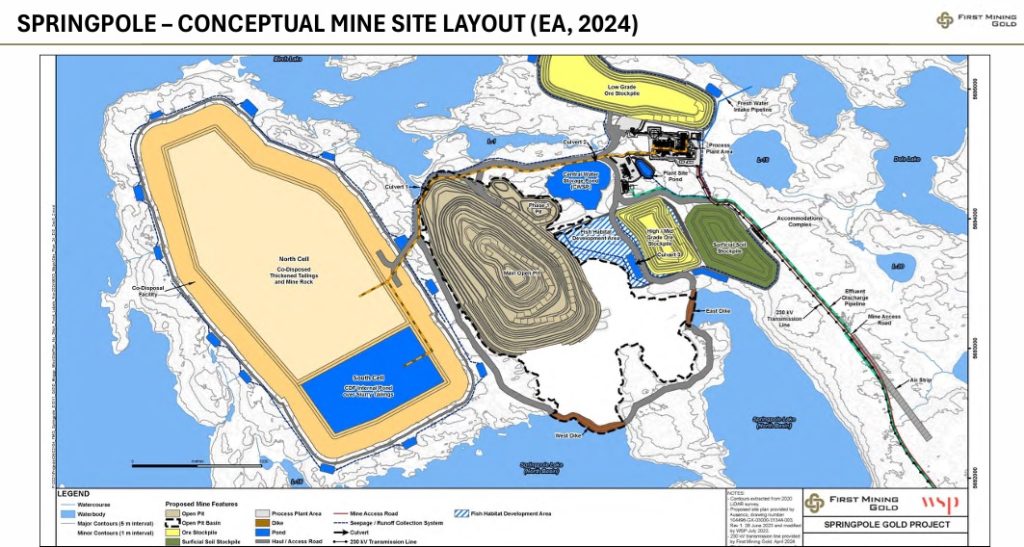

First Mining Gold (TSX: FF)’s Springpole is likely to become Canada’s next major gold project to receive environmental approval later this year, which would allow it to become permitted and potentially developed into Canada’s next major gold mine.

FF and Lahontan Gold (TSXV: LG) continue to trade with some of the lowest market caps per ounce of gold resources in the entire industry.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA has received compensation from CTGO of US$30,000 cash for three months of coverage and could receive a total of up to US$80,000 cash for ten months of coverage. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. NIA has received compensation from MGG of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a three-month marketing contract which has since expired. NIA has received compensation from HSTR of US$30,000 cash for three months of coverage and could receive a total of up to US$100,000 cash for twelve months of coverage. NIA has received compensation from LG of US$30,000 cash for a three-month marketing contract. NIA’s President has purchased 200,000 shares of LG in the open market and intends to buy more shares. NIA received compensation from PNPN of US$50,000 cash for a six-month marketing contract which has since expired but may receive additional compensation for additional contracts in the future. This message is meant for informational and educational purposes only and does not provide investment advice.