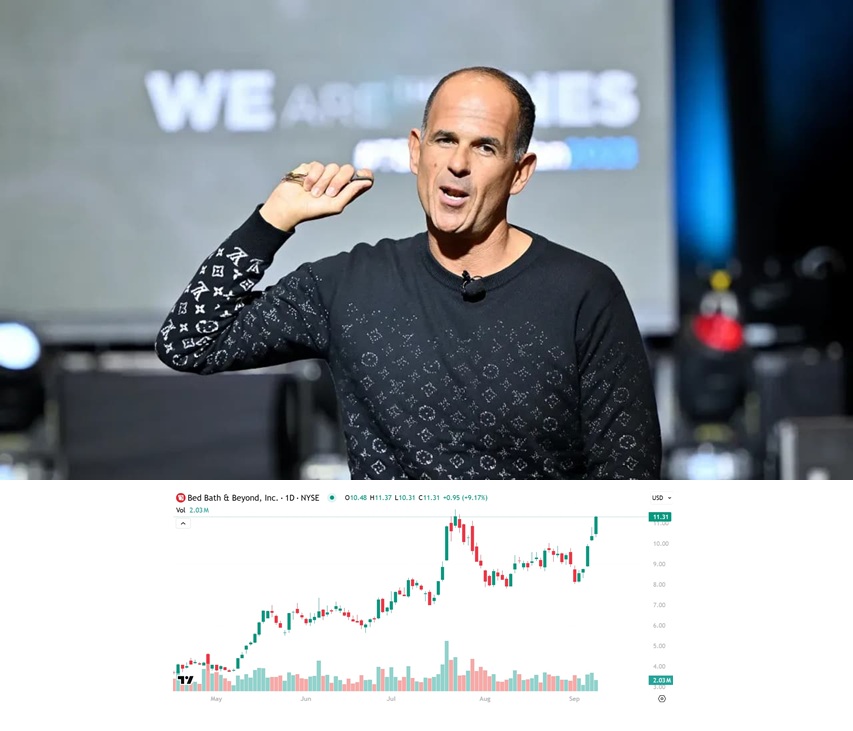

NIA’s #1 Crypto/Blockchain Play BBBY Up 9.17% to $11.31 Per Share

NIA’s #1 favorite Crypto/Blockchain stock suggestion Bed Bath & Beyond (BBBY) is up by 9.17% today to $11.31 per share for a gain of 57.96% since NIA’s July 1st suggestion at $7.16 per share.

The #1 question that you need to ask yourself when researching any Crypto, blockchain, or other technology stock:

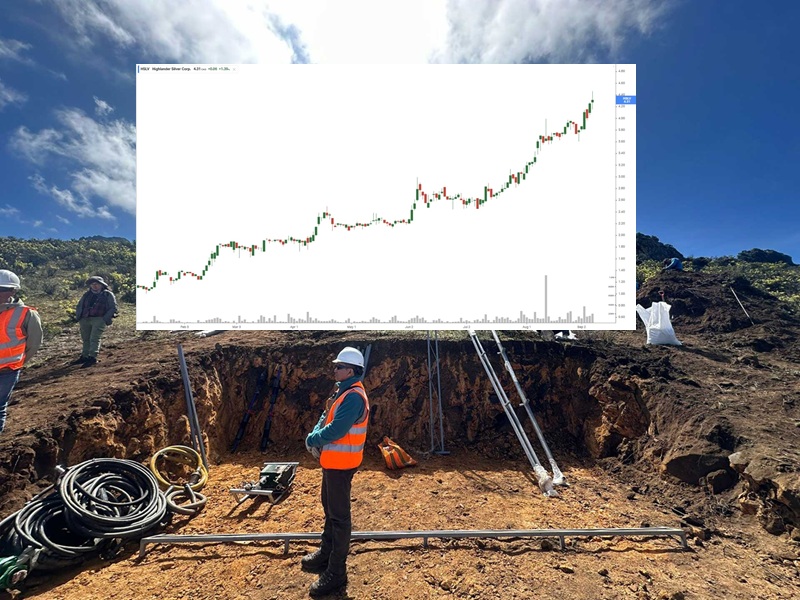

Does it have as much upside as First Mining Gold?

Does it have less downside than First Mining Gold?

Is it as undervalued as First Mining Gold?

Does it have a catalyst ahead in the upcoming months as big as First Mining Gold?

For 100% of all Crypto related stocks other than BBBY the answer to these questions is no.

For BBBY we believe taking tZERO public in an IPO on the NYSE will be a pretty big deal especially since Intercontinental Exchange (ICE) the NYSE parent company is the second largest tZERO shareholder after BBBY. Even if tZERO is all hype and the valuations of all blockchain technology companies continue to collapse, we do like BBBY’s strategy of opening new smaller, cheaper, and more efficient Bed Bath & Beyond Home stores. Even if tZERO is viewed as worthless twelve months from now at least BBBY is trying to do something real in addition to this.

While Bullish (BLSH), Circle (CRCL), and Strategy (MSTR) continue to collapse… NIA’s BBBY is likely to become the only Crypto/Blockchain play to make large gains in the entire market!

Obviously First Mining Gold (TSX: FF) is the much better overall opportunity at a market cap of US$18 per oz of gold resources! FF’s Springpole EA approval seems like it could line up perfectly with Zijin Gold raising $3 billion in its IPO!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from FF of US$50,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.