Trio-Tech (TRT): Hidden AMD-OpenAI Link Positions Stock for Massive 2026 Rerating

Trio-Tech International (TRT) is significantly undervalued compared to Aehr Test Systems (AEHR) when considering… the implications of the AMD-OpenAI partnership, Trio-Tech's demonstrated revenue growth momentum, and the company's hidden exposure to AI infrastructure expansion. Their most recent quarterly results show a dramatic reversal of the narrative that has driven Aehr's premium valuation: Trio-Tech's fiscal 4Q 2025 revenue grew by 10.3% year-over-year to $10.7 million, while Aehr's fiscal 1Q 2026 revenue declined by 16.4% year-over-year to $11.0 million. Additionally, this month's AMD-OpenAI strategic partnership announcement, which commits to deploying six gigawatts of AMD AI infrastructure beginning in 2026, directly validates the semiconductor back-end testing services that Trio-Tech has been quietly providing to AMD for over two decades, potentially setting the stage for significant revaluation if the market fully appreciates Trio-Tech's hidden leverage to this massive AI deployment cycle.

The most striking recent development is the complete reversal in quarterly earnings momentum between the two companies, which contradicts the prevailing market narrative about Aehr's growth dominance. Aehr's most recent quarter showed concerning revenue dynamics, with fiscal 1Q 2026 revenue of $11 million declining by 16.4% year-over-year from $13.1 million in the comparable prior year period. This represented a miss against analyst estimates of $11.48 million, despite management's claims of being ahead of street consensus, alongside a GAAP net loss of ($2.1 million). The company's bookings of $11.4 million for the quarter represented a decline in velocity compared to the prior year's run rate, suggesting that Aehr's much-hyped AI processor wins may not be translating into the rapid revenue acceleration that justified its premium valuation.

In stark contrast, Trio-Tech International (TRT) demonstrated positive earnings momentum in its most recent quarter, with fiscal 4Q 2025 revenue of $10.7 million increasing by 10.3% year-over-year from $9.7 million in the prior year comparable quarter. More significantly, the company achieved net income of $183,000, demonstrating profitability compared to Aehr's net losses. The composition of Trio-Tech's growth is particularly revealing: Industrial Electronics segment revenue surged by 70% year-over-year to $4.1 million, driven by aviation channel expansion, while Semiconductor Back-End Solutions maintained stability at $6.6 million despite China weakness. For the full 2025 fiscal year, Trio-Tech achieved profitability of $630,000 after excluding a one-time foreign exchange impact of $671,000, demonstrating operational resilience that contrasts sharply with Aehr's trailing twelve-month GAAP net loss of ($6.65 million).

The earnings trend becomes even more compelling when considering the forward trajectory suggested by each company's guidance and commentary. Aehr withdrew formal guidance for fiscal year 2026 citing tariff-related uncertainty and has remained cautious despite the promised AI upside, suggesting management recognizes near-term execution risks that its valuation multiples may not be fully pricing in. Trio-Tech, conversely, expressed confidence in its positioning, highlighting a strategic inflection point in its evolution. Trio-Tech management emphasized robust 70% revenue growth in its Industrial Electronics segment, which is emerging as a new profit center, and underscored plans to leverage its expanding Southeast Asian footprint as global semiconductor supply chains shift toward Malaysia and Thailand. With $19.5 million in cash+deposits, reduced liabilities, and the pending full acquisition of its Malaysian subsidiary, Trio-Tech conveyed confidence in its capacity to invest for growth even amid trade-related volatility. The tone of the release contrasts sharply with Aehr’s caution, signaling a management team focused on operational resilience, diversification, and sustainable long-term expansion rather than short-term narrative-driven catalysts.

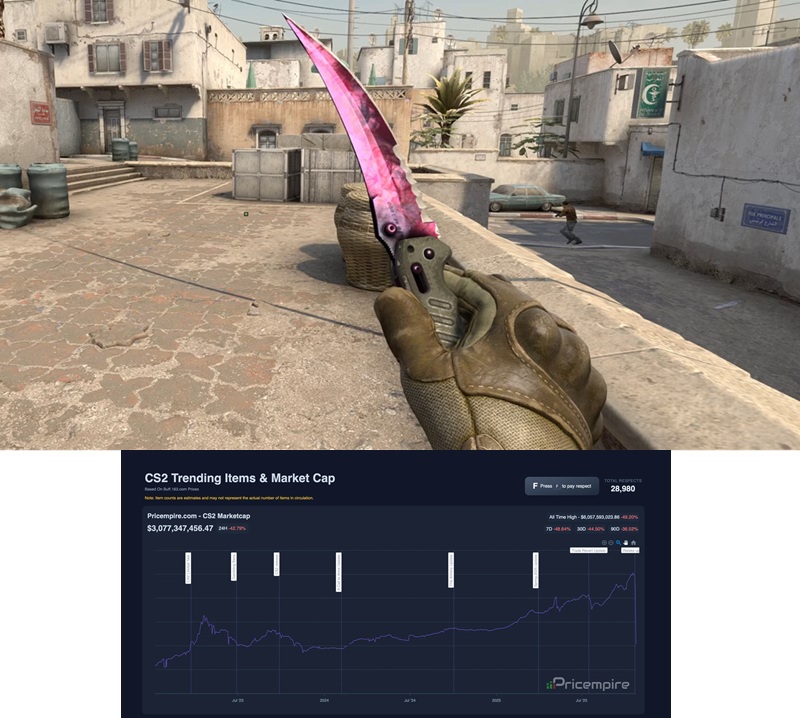

AMD's newly announced multi-year, multi-generation agreement with OpenAI directly validates the massive growth trajectory for semiconductor back-end testing and reliability qualification services that Trio-Tech has been positioned to capture, yet the market has systematically undervalued this exposure. The AMD-OpenAI deal represents an unprecedented scale of GPU deployment for AI infrastructure, with financial projections suggesting tens of billions of dollars in AMD revenue over the contract period. Critically, Trio-Tech's customer relationship with AMD as a long-standing testing services provider position the company directly in the supply chain for this massive GPU expansion.

While Trio-Tech's more recent SEC filings anonymize its largest customers as "Customer A, B, and C," contributing approximately 20%, 17%, and 10% of revenue respectively, historical 10-K filings explicitly identified AMD, Infineon, and NXP Semiconductors as major customers. This pattern of anonymization is consistent with companies maintaining long-standing supplier relationships where the customer explicitly prefers public anonymity. The inference that "Customer A" represents AMD is reasonable given the timing of anonymization, the scale of revenue contribution matching historical AMD proportions, and the fact that AMD remains one of the world's largest semiconductor manufacturers and is now scaling AI GPU production at unprecedented volumes. If the market were to receive confirmation that Trio-Tech represents a key back-end testing partner for AMD's OpenAI GPU deployment, the valuation rerating could be dramatic. Given that AMD's six-gigawatt GPU commitment requires extensive testing and qualification at multiple stages of manufacturing, and that Trio-Tech's established testing services infrastructure in Singapore, Malaysia, and Thailand positions it advantageously for supporting AMD's supply chain regionalization initiatives, the hidden leverage to AI infrastructure expansion appears substantial and largely unappreciated by the market.

Trio-Tech International (TRT)'s EV testing capability directly parallels Aehr's market positioning in SiC and GaN testing, which has historically been positioned as a core growth driver for Aehr. The fact that both companies have independently recognized the criticality of SiC and GaN testing for automotive applications validates the legitimacy of this market segment and suggests that Trio-Tech's more mature, operationally proven approach to solving these testing challenges represents genuine competitive positioning rather than aspirational capabilities. The significance of this convergent product development becomes apparent when considering that the automotive semiconductor testing market represents another massive secular growth driver alongside AI, with EV production expected to expand dramatically over the next five years. Trio-Tech's established relationships with major automotive semiconductor suppliers like Infineon and NXP, combined with its proven manufacturing and testing capabilities in the APAC region, position the company to capture significant testing volume as SiC and GaN adoption accelerates across the automotive industry. The fact that Aehr's stock has appreciated significantly on SiC and GaN narratives, yet Trio-Tech trades at an enterprise value of less than 0.37x revenue despite similar product positioning and better recent earnings momentum, suggests a once in a decade valuation arbitrage opportunity!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only.