High Grades. Low Strip. Big Upside. Lahontan Gold’s Santa Fe Advantage

Lahontan Gold (TSXV: LG): A High-Grade, Royalty-Light Gold Developer in Nevada’s Mining Heartland

Published: August 5, 2025 at 2:54 AM ET | LG Price at Publication: $0.10/share

Ticker: TSXV: LG

Flagship Asset: Santa Fe Mine, Nevada

Resource Base: 1.95 million oz AuEq

Market Cap (approx.): ~1/10th of post-tax NPV at $2,705 gold

Overview

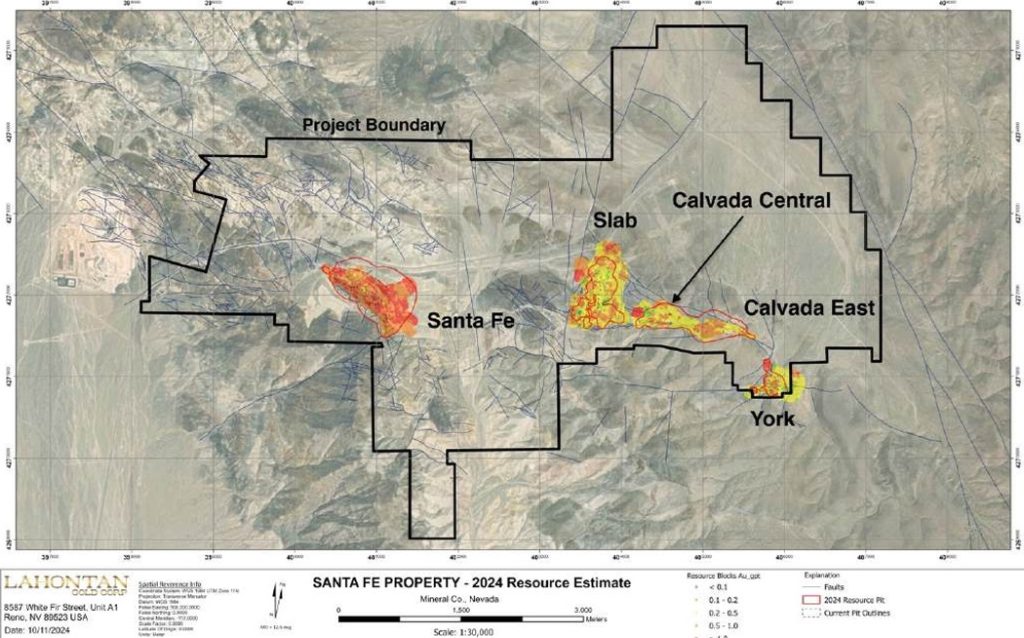

Lahontan Gold (TSXV: LG) is advancing its flagship Santa Fe Mine in Nevada, one of the most mining-friendly jurisdictions globally. The 26.4 km² project has a history of production, having yielded 359,202 ounces of gold and 702,067 ounces of silver through open-pit, heap-leach methods.

Today, Santa Fe hosts a robust 1.95 million ounce AuEq resource:

- 1.54 Moz AuEq Indicated

- 0.411 Moz AuEq Inferred

With a low strip ratio, superior grades, and strong infrastructure already in place, Lahontan is strategically positioned for near-term development.

Superior Grade Profile

Santa Fe’s average grade of 0.99 g/t AuEq (Indicated) is 60–100% higher than typical open-pit heap-leach projects in Nevada and worldwide, many of which operate at just 0.4–0.6 g/t Au. This high-grade advantage enhances project economics, especially in a high-cost inflationary environment.

Strong Preliminary Economic Assessment (PEA) Economics

- Post-tax NPV: US$200 million (based on $2,705/oz gold)

- Initial CAPEX: US$135 million

- Cash Costs: US$1,233/oz

- Production Profile: ~50,000 oz AuEq per year

- Strip Ratio: 1.63:1 (well below industry averages of 2.5:1 to 8:1)

The PEA supports a scalable, low-cost operation leveraging open-pit and heap-leach simplicity. With a current market cap of just a fraction of NPV, Lahontan presents clear re-rating potential.

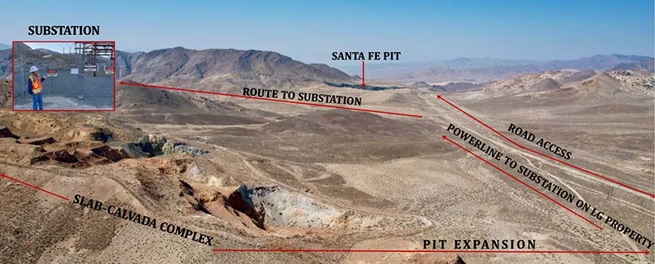

Excellent Infrastructure in Place

- On-site power substation

- All-season access roads

- Three water wells

- Established past-producing site

These advantages reduce both upfront capital requirements and permitting timelines.

High-Grade Growth Potential from Drilling

Lahontan’s 2025 drill campaigns are aggressively targeting expansion zones including:

- Bonanza Zone – 4.6m @ 112.3 g/t Au

- Big Horn, Slab, Calvada, York, Pinnacle Zones – all open for expansion

The company mobilized an RC rig in June 2025, targeting Slab and York zones, with assays expected imminently. New intercepts could meaningfully expand the existing resource and improve mine scale.

Metallurgical Testing & De-risking in Progress

Lahontan is actively advancing toward feasibility through:

- Metallurgical testing to improve recovery assumptions

- Historical oxide recoveries: ~60–70%

- PEA conservatively assumes 49% recovery for transition material

- Ongoing optimization efforts aim to unlock significant upside through modern heap leach processing of transition ores.

Permitting Advancing Toward NEPA

The U.S. Bureau of Land Management is reviewing Lahontan’s Exploration Plan of Operations (EPOO). NEPA permitting is expected to begin in late 2025. In the interim, drilling continues under a Notice of Intent.

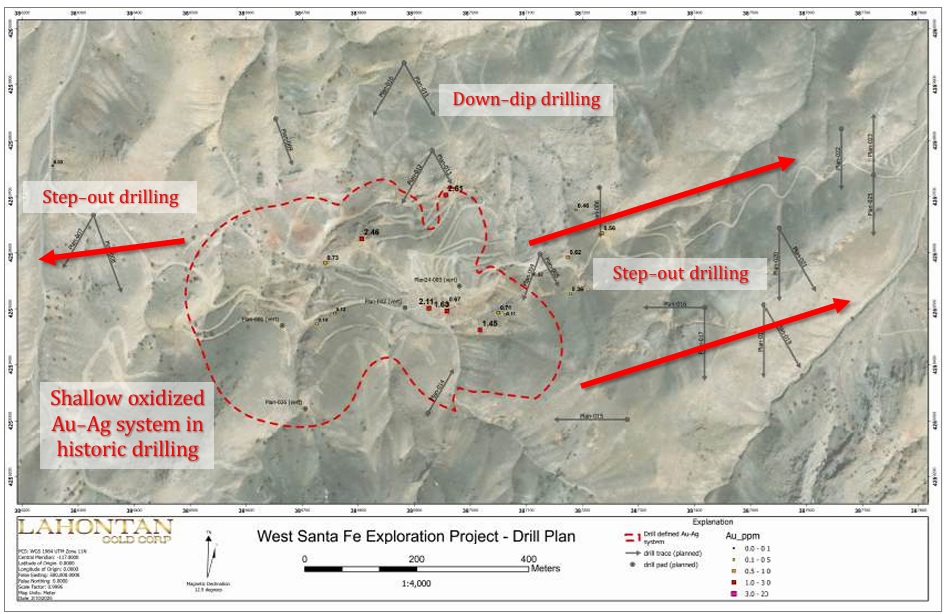

Strategic Expansion: West Santa Fe Satellite Project

Just 15 km from Santa Fe, Lahontan’s newly acquired West Santa Fe asset:

- Hosts 171 historic drill holes (13,000m)

- Shows shallow, oxidized gold-silver mineralization

- Could form a standalone heap-leach project or satellite deposit

- 2025 plans include 6,300m of step-out drilling to validate and expand resources

This enhances Lahontan’s district-scale potential while leveraging shared infrastructure.

Favorable Share Structure and Investor Base

Following the Victoria Gold block sale, Lahontan’s shareholder base is now comprised largely of long-term, supportive holders controlling over 50% of the float. This sets up a tightly held structure with reduced dilution risk and clear alignment with value creation.

- Stock hit a low of $0.02 post-block sale

- Traded as high as $0.45 in April 2022

- The TSX Venture Index is rebounding, offering sector-wide tailwinds

Royalty-Light Profile Enhances Value

Approximately 79% of Santa Fe’s land package is unencumbered by royalties, including:

- Historic pits

- Core mineralized zones

- Most drill-defined resources

Of the remaining royalty-bearing ground, most carry only a 1.25% NSR, making Santa Fe one of the cleanest, most scalable assets among junior developers. This royalty-light structure directly improves project margins and attractiveness to future partners or acquirers.

Investment Highlights

✅ 1.95 Moz AuEq resource base, scalable and growing

✅ High-grade open-pit heap-leach profile (0.99 g/t AuEq)

✅ Top-tier jurisdiction with permitting and infrastructure advantages

✅ $200M post-tax NPV, with low initial CAPEX

✅ Royalty-light and capital-efficient development model

✅ Near-term catalysts: drilling results, metallurgical improvements, permitting milestones

✅ Strategic upside at West Santa Fe, offering standalone potential

Conclusion: Positioned for Re-rating

Lahontan Gold offers a compelling mix of grade, scale, jurisdiction, and economic leverage—a rare combination in today’s gold market. As drilling continues and permitting advances, the company is executing a clear roadmap toward production readiness. With strong fundamentals and a resource base trading at a deep discount to net asset value, Lahontan represents a high-upside, de-risking gold investment in the heart of Nevada.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from LG of US$50,000 cash for a six-month marketing contract. NIA’s President has purchased 200,000 shares of LG in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.