All Mining Companies = $2T vs. Nvidia $4.5T

All global mining companies combined are worth a new record high $2 trillion, but this is nothing compared to Nvidia alone being worth $4.5 trillion.

If every global mining company suddenly went away… we’d have no electricity grids, no cars, no buildings, no computers, no phones, no batteries, no solar panels, and no data centers. Every one of those technologies depends on mined materials like copper, nickel, lithium, iron, aluminum, gold, and rare earth elements. The entire modern world would grind to a halt within days.

By contrast, if Nvidia disappeared, we might be better off. Without its GPUs, the boom in copyright violations, deepfakes, algorithmic manipulation, and mass surveillance would slow down dramatically, yet civilization would still function. People would still build homes, drive cars, generate power, and communicate. Within a year, another company like AMD would fill the gap.

Nvidia is now worth more than the GDP of every country except the U.S. and China. It’s worth more than Japan, Germany, India, or the entire United Kingdom’s economy. Put differently, Nvidia’s market value equals the total annual output of about 200 smaller nations combined. For Nvidia to double again to $9 trillion, the world would need to double the physical infrastructure that powers its chips. Every additional GPU requires exponentially more electricity, copper wiring, silicon wafers, rare-earth magnets, and cooling metals… all of which come from mining. Even before the AI boom, the world’s electrical grid was straining under the weight of Bitcoin mining, which exploits the energy market by securing low, fixed-rate power, and then selling it back to the grid at high prices during peak demand or emergencies, profiting millions while regular consumers are asked to conserve energy.

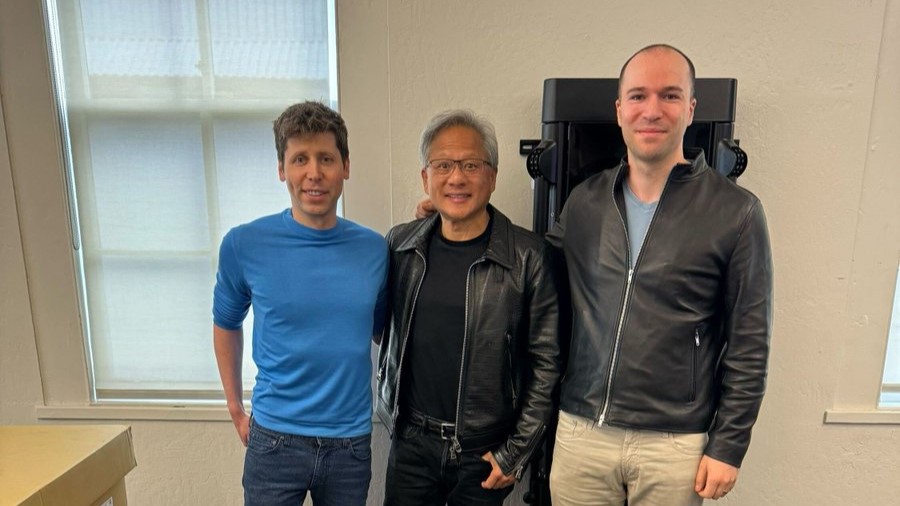

If OpenAI is losing money today how will more AI compute power make them profitable? It won’t, it makes Nvidia more profitable which then invests the money into OpenAI so that it can buy more chips from Nvidia to invest more into OpenAI allowing OpenAI to pay for datacenter usage at Microsoft, Oracle, and Coreweave so that they can then reinvest into OpenAI.

| # | Parties Involved | Transaction | Amount | Direction of Money Flow | Notes |

|---|---|---|---|---|---|

| 1 | OpenAI → AMD | Buys 5M GPUs | $100 B | OpenAI → AMD | Hypothetical; mirrors rumored 2025 discussions. |

| 2 | AMD → OpenAI | Gives stock “back” | $100 B | AMD → OpenAI | Hypothetical; tech-for-equity illustration. |

| 3 | OpenAI → Nvidia | GPU purchase | $200 B | OpenAI → Nvidia | Illustrative; real orders ≈ $10–15 B/yr. |

| 4 | Nvidia → OpenAI | “Invests” back | $100 B | Nvidia → OpenAI | Hypothetical; partnership equity concept. |

| 5 | OpenAI → Oracle | Data-center contract | $300 B | OpenAI → Oracle | Reported (Project Stargate, 2027 start). |

| 6 | Oracle → Nvidia | Buys GPUs | $300 B | Oracle → Nvidia | Partly real; Reuters cites $40 B initial order. |

| 7 | Nvidia → OpenAI | Re-investment loop | $300 B | Nvidia → OpenAI | Hypothetical; completes circular flow. |

| 8 | Microsoft → OpenAI | Cloud credits + equity | $10 B | Microsoft → OpenAI | Real (2023); Azure partnership. |

| 9 | OpenAI → Microsoft | Pays for Azure | $5 B / yr | OpenAI → Microsoft | Realistic reciprocal flow; boosts revenue. |

| 10 | Amazon (AWS) → Anthropic | Funding + credits | $4 B | AWS → Anthropic | Real (2023–24) deal. |

| 11 | Anthropic → AWS | Compute usage | $4 B | Anthropic → AWS | Reciprocal; offsets AWS investment. |

| 12 | Google → Startups | Invests + cloud tie-in | $2 B | Google → Startups | Real trend; Cohere / Anthropic deals. |

| 13 | Startups → Google Cloud | Buys services | $1.5 B | Startups → Google | Illustrative loop; mirrors AWS model. |

| 14 | Nvidia → CoreWeave | Strategic investment | $100 M | Nvidia → CoreWeave | Real (2023) GPU-infra alliance. |

| 15 | CoreWeave → Nvidia | Buys H100/H200 GPUs | $500 M + | CoreWeave → Nvidia | Real pattern; reinvests capital. |

| 16 | Elon Musk (Tesla sales) → xAI | Founder funding | $1 B + | Musk → xAI | Real; seed capital via Tesla stock sales. |

| 17 | Nvidia → xAI | Equity investment | Billions (undisclosed) | Nvidia → xAI | Reported 2025; tied to Colossus 2 build. |

| 18 | xAI → Nvidia | Buys GPUs | Multi-B | xAI → Nvidia | Likely real; supports data-center expansion. |

| 19 | Tesla → xAI | Proposed investment | TBD | Tesla → xAI | Proposal 7 (2025) shareholder vote pending. |

| 20 | Investors → SPV → xAI | GPU lease financing | $7.5 B + $12.5 B debt | Investors → SPV → xAI | Reported SPV structure; off-balance-sheet assets. |

| 21 | OpenAI ↔ CoreWeave | Compute partnership | $10–20 B | Two-way | Real collaboration; rented GPU capacity. |

| 22 | Meta / Google / AWS → Nvidia | Industry-wide GPU orders | Hundreds of billions | Firms → Nvidia | Aggregate trend; fuels 1600% NVDA rally. |