North Peak Resources (TSXV: NPR) Discovers High-Grade Gold of Up to 180 g/t Au at Prospect Mountain Mine Complex

North Peak’s Follow-Up Channel Sampling in Lower Dean Cave Complex Reveals Further High-Grade Gold, up to 180 g/t Au, 998 g/t Ag at the Prospect Mountain Mine Complex

August 05, 2025 7:00 AM EDT

Calgary, Alberta–(Newsfile Corp. – August 5, 2025) – North Peak Resources Ltd. (TSXV: NPR) (OTCQB: NPRLF) (the “Company” or “North Peak“) announces results from follow-up sampling within the Dean Cave complex at their Prospect Mountain (PM) property in Eureka, Nevada (the “Property“).

Following the Company’s press release on 27th May, 2025 where the Company reported high grade oxide mineralization in the Dean Cave area grading up to 46.5 g/t (1.36 oz/t) Au, 569 g/t (16.6 oz/t) Ag, further channel sampling was undertaken in the East Cave area on the 650′ level, some 46m (150ft) below the previously announced samples, and encountered multiple narrow high grade gossanous zones within a zone of heavily altered dolomite, including:

- 180 g/t (5.8 oz/t) Au, 998 g/t (32 oz/t) Ag, 7.8% Pb, 1.05% Zn over 0.1m

- 66 g/t Au, 371 g/t Ag, 2.85% Pb, 3.74% Zn over 0.16 m

- 49.5 g/t Au, 402 g/t Ag, >20% Pb, 0.64% Zn over 0.09m

- 27.3 g/t Au, 132 g/t Ag, 1.9% Pb, 2.9% Zn over 0.1m

Only the gossanous zones were sampled in this sampling pass, given the high-grade nature of these zones the rest of the altered dolomite will be sampled to give better indications of potential historical grades from these old stope areas. The mineralization here appears strongly structurally controlled by the intersection of two fault systems, giving a plunge direction to explore for further mineralization along. This cave can be directly accessed by the Silver Connor portal from the west side of the mountain.

“These further high-grade results continue to demonstrate the strength and potential of this Property. Our geology team has been utilizing Prospect Mountain’s extensive and accessible underground workings to build a greater understanding of the complex structural controls to mineralization,” commented Rupert Williams, CEO. “We expect our summer 2025 drill program to commence in September, with a plan to target several different structural control systems and will consider targeting this area with an additional RC drillhole from surface.”

“The Company’s understanding of the complex structural controls to mineralization is rapidly advancing, increasing the likelihood of effectively targeting new zones of mineralization as has successfully been done elsewhere in the Eureka camp,” added David Pym, Lead Geologist. “These samples reinforce our exploration strategy of looking at the Property from three perspective target areas: the near surface oxide, underground oxide and the underground sulphide.”

Background to the Areas

The Dean Cave complex was one of the last areas to be mined in the historic Diamond mine, with sporadic activity continuing into the 1980’s. The ore in Carbonate Replacement Deposits often occurs in vertical chimneys and layer parallel mantos. The Dean Cave area is one of a series of historical high grade chimney stopes in the northern part of the Diamond Mine, known as the Dean Cave complex which include the DMEA/Deadbroke chimney and the East Cave chimney. The Deadbroke/DMEA chimney extends from surface down to at least 400m and the Dean and East Cave chimneys have only been exploited from underground and extend for at least 100m upwards from the historic 650 level of the mine. At depth, they appear truncated by the west dipping Dominic fault, which may displace their depth extents. The chimney zones occur along an ENE trending fracture zone parallel to the Silver Connor Fault near the intersection with steeply dipping NW fault zones associated with the Banner McIntosh fault system and represent an underground oxide exploration target with high potential for further mineralization, both towards surface and to depth. The Dean Cave stopes for which we have production records averaged 0.229 oz/t (7.8 g/t) Au, 5.83 oz/t (200 g/t) Ag from 291 ore cars (Silver Viking Corp., 1980, map DM0-08 -Note: These records are historical and have not been verified).

The DMEA refers to the area that was briefly mined around 1954 following a loan being granted by the Defense Minerals Exploration Administration for development costs. Material generated averaged 0.69 oz/t Au, 50.5 oz/t Ag, 29.4% Pb. The Deadbroke area is around 500m south of the Wabash/Williams historic mining area, where the 2024 drill program was focused, and at surface a number of patented claims sit, which are owned 100% and include Old Put and Antelope (see figure 1).

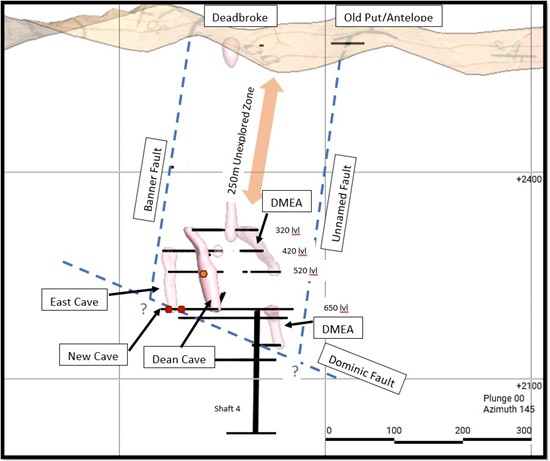

Figure 1: Section along ENE fracture zone, looking SE showing historic chimneys and underground workings. Dean Cave sample location in Orange, New Cave samples in Red. It is unknown if the faults continue below the Dominic Fault.

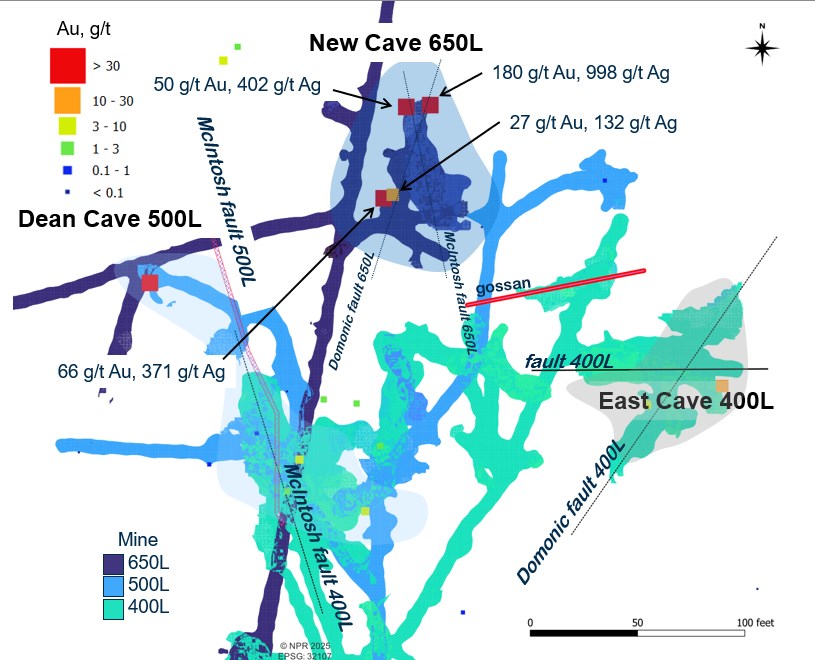

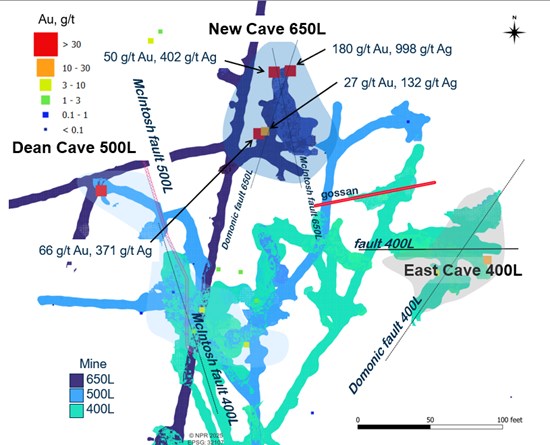

Figure 2: Plan of Dean Cave complex showing sample locations on multiple levels.

Table 1: Assay Results

| Sample | East, m |

North, m |

Elevation, m |

Type | Length, m |

Lithology | Au, g/t |

Ag, g/t |

Pb, % |

Zn, % |

| 2025061401 | 164702.6 | 8524158.6 | 2201.0 | channel | 0.16 | gossan | 66 | 371 | 2.85 | 3.74 |

| 2025061402 | 164703.9 | 8524159.1 | 2201.0 | channel | 0.1 | gossan | 27.3 | 132 | 1.91 | 2.92 |

| 2025061403 | 164709.2 | 8524171.9 | 2201.0 | channel | 0.1 | gossan | 180 | 998 | 7.76 | 1.05 |

| 2025061404 | 164705.8 | 8524171.6 | 2201.0 | channel | 0.09 | gossan | 49.5 | 402 | > 20 | 0.64 |

Review by Qualified Person, Quality Control and Reports

Mr. David Pym, CGeol., Consulting Geologist for the Company, is the Qualified Person, as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, who reviewed and approved scientific and technical disclosure in this press release. The Qualified Person has not reviewed the mineral tenure, nor independently verified the legal status and ownership of the Property or any underlying property agreements.

Samples in this case are channel samples taken from outcrops in historic stopes and caves. Samples are loaded into a plastic crate and dispatched daily to the ALS Global prep-lab in Elko Nevada. A standard, a blank and a field duplicate were inserted after every 20 samples, for a QA/QC rate of 15%. Six standards from CDN Resource Laboratories were rotated through the samples. The standards had gold values ranging from 0.433 to 7.34 ppm.

Samples are dried crushed and pulverised and assayed for gold with a 30g fire assay and a 44 element ICP MS suite. Overlimit samples for gold, silver, lead, zinc and copper are automatically re-assayed by suitable methods.

About North Peak

The Company is a Canadian based gold exploration and development company listed on the TSX Venture Exchange under the symbol “NPR” and the OTCQB under the symbol “NPRLF”. Launched by the founding team behind both Kirkland Lake Gold and Rupert Resources, the team has a strong track record of acquiring mining assets, applying modern exploration techniques and taking them into operational mines.

North Peak’s flagship property is the Prospect Mountain Mine complex which lies in the Battle Mountain Eureka trend, in an area known as the Southern Eureka Gold Belt, where three styles of mineralization have been identified, gold, silver Carlin style mineralization, Carbonate Replacement gold, silver, lead, zinc mineralization (CRD) and carbonate hosted Porphyry Related Skarn lead, zinc and gold mineralization associated with cretaceous intrusions. At the Property, the CRD mineralization is heavily oxidized to depths of at least 610m (2,000ft) below the top of the ridge line.

A Plan of Operations is in place which covers part of the Property and entitles an operator to pursue surface exploration (totalling 189 acres), underground mining of up to 365,000 tons per annum and certain infrastructural works. A more complete description of the Property’s geology and mineralization, including at the Wabash area, can be found in the NI 43-101 Technical Report (the “Technical Report”) on the Prospect Mountain Property, Eureka County, Nevada, USA dated and with an effective date April 10, 2023, prepared by David Pym (Msc), CGeol. of LTI Advisory Ltd. and Dr Toby Strauss, CGeol, EurGeol., of Merlyn Consulting Ltd., which has been filed on SEDAR+ at www.sedarplus.ca under the profile of the Company and on the Company’s website.

For further information, please contact:

| Rupert Williams, CEO Phone: +1-647-424-2305 Email: info@northpeakresources.com Website: www.northpeakresources.com |

Chelsea Hayes, Director Phone: +1-647-424-2305 Email: info@northpeakresources.com |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS: This press release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, timing and completion of any drilling and work programs on the Property, estimates of mineralization from drilling, sampling and geophysical surveys, geological information projected from drilling and sampling results and the potential quantities and grades of the target zones, the potential for minerals and/or mineral resources and reserves, and statements regarding the plans, intentions, beliefs, and current expectations of the Property and the Company that may be described herein. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as “may”, “expect”, “estimate”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur.

By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, estimates, forecasts, projections and other forward-looking statements will not occur. These assumptions, risks and uncertainties include, among other things, the state of the economy in general and capital markets in particular, accuracy of assay results, geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services, future operating costs, and the historical basis for current estimates of potential quantities and grades of target zones, as well as those risk factors discussed or referred to in the Company’s Management’s Discussion and Analysis for the year ended December 31, 2024 and the quarter ended March 31, 2025, available at www.sedarplus.ca, many of which are beyond the control of the Company. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this press release are made as of the date of this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of, or statements made by, third parties in respect of the matters discussed above.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA has received compensation from NPR of US$50,000 cash for a six-month marketing contract and previously received US$50,000 cash for a six-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.