Minaurum Silver (TSXV: MGG)’s Fully Permitted Alamos Polymetallic Silver District

Published: June 8, 2025 at 4:59 AM ET | MGG Price at Publication: $0.2575/share

Minaurum Silver Inc. (TSXV: MGG) owns 100% of the Alamos Silver Project in Sonora, Mexico—an emerging world-class polymetallic silver system unmatched in scale, grade, and advancement. Unlike many higher market cap peers stalled by permitting hurdles, Alamos is fully permitted for production today.

Peer Comparison:

Minaurum Silver (TSXV: MGG) is the only peer with a full 30-year MIA production permit in place:

| Company | Market Cap on June 8, 2025 | Surface Agreements | Exploration Agreements | NI 43-101 Resource | MIA Production Permit |

|---|---|---|---|---|---|

| Discovery Silver | US$1.99B | ✅ | ✅ | ✅ | ❌ |

| Vizsla Silver | US$1.01B | ✅ | ✅ | ✅ | ❌ |

| GoGold Resources | US$629.86M | ✅ | ✅ | ✅ | ❌ |

| Prime Mining | US$198.84M | ✅ | ✅ | ✅ | ❌ |

| Silver Tiger Metals | US$118.61M | ✅ | ✅ | ✅ | ❌ |

| Minaurum Silver | US$74.89M | ✅ | ✅ | 🕒 2025 | ✅ |

Alamos Silver Project Key Highlights

- 37,928-hectare land package in a historic high-grade silver camp

- Long-term federal and local permits in place for production and exploration

- 29-year surface access agreements signed in Dec 2024

- No material impact from Mexico’s 2023 mining reform

- NI 43-101 resource estimate expected in 2025, targeting 50+ Moz AgEq from just 2 of 26 vein zones

- Drill intercepts up to 4,173 g/t AgEq confirm exceptional high-grade zones

- Historical production: ~200M oz silver from Promontorio, Europa, and Quintera veins

Geology: A Giant Epithermal System Emerging

Alamos hosts a large-scale low-sulfidation epithermal system with true district-scale potential. A broad network of structurally distinct vein zones—spanning multiple orientations and mineralization styles—suggests a long-lived, multi-phase hydrothermal system.

Hosted in Cretaceous limestone and Tertiary volcanics, the geology mirrors Mexico’s most prolific silver belts—Fresnillo, Guanajuato, and Palmarejo. Yet unlike those mature camps, Alamos remains 85% unexplored, offering rare upside in one of the world’s premier silver jurisdictions.

Few juniors control an epithermal silver system this vast, this high-grade, and this underexplored—on a scale geologically comparable to Mexico’s great historic camps.

Recent drilling has returned average grades of 220 g/t Ag, 0.40% Cu, 0.96% Pb, and 2.05% Zn, or 365 g/t AgEq.

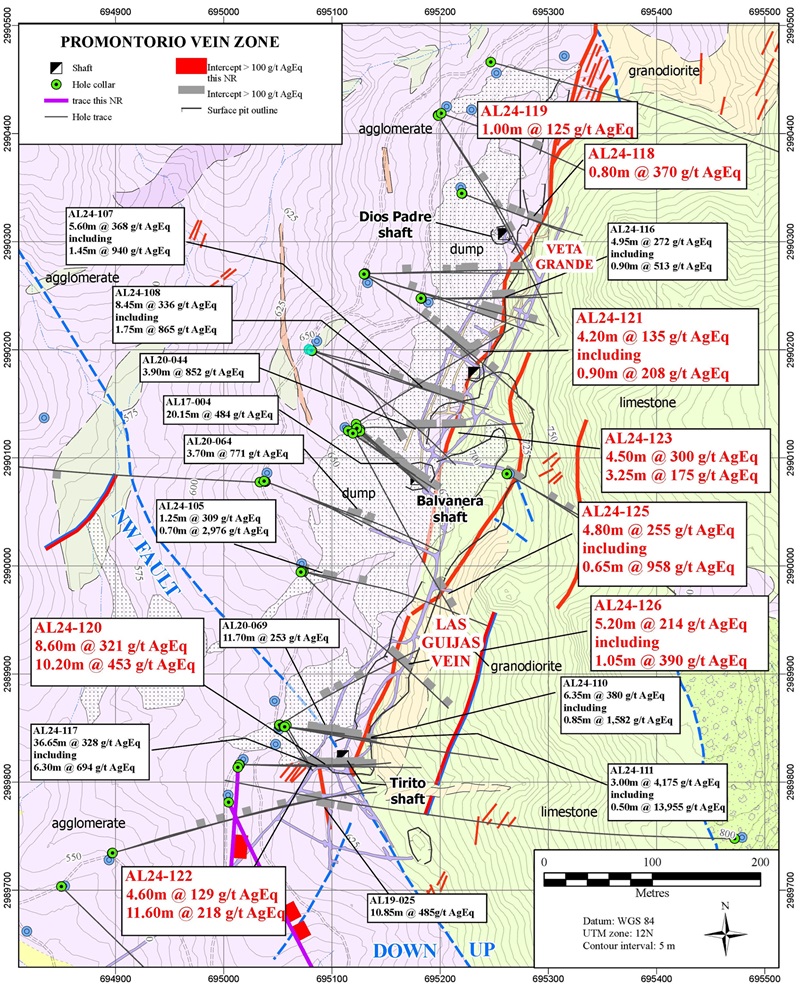

Recent Drilling Intercepts

| Hole ID | Interval (m) | Grade |

|---|---|---|

| AL24-105 | 1.25 | 309 g/t AgEq (198 g/t Ag, 0.34% Cu, 1.2% Pb, 2.3% Zn) |

| AL24-105 | 0.70 | 2,976 g/t AgEq (2,015 g/t Ag, 1.8% Cu, 4.1% Pb, 8.7% Zn) |

| AL24-107 | 5.60 | 368 g/t AgEq (243 g/t Ag, 0.41% Cu, 1.4% Pb, 3.0% Zn) |

| AL24-107 | 2.55 | 621 g/t AgEq (412 g/t Ag, 0.70% Cu, 2.4% Pb, 5.0% Zn) |

| AL24-108 | 8.45 | 336 g/t AgEq (220 g/t Ag, 0.38% Cu, 1.3% Pb, 2.7% Zn) |

| AL24-110 | 6.35 | 380 g/t AgEq (250 g/t Ag, 0.43% Cu, 1.5% Pb, 3.1% Zn) |

| AL24-111 | 3.00 | 4,173 g/t AgEq (2,830 g/t Ag, 3.2% Cu, 8.3% Pb, 15.5% Zn) |

| AL24-112 | 5.75 | 189 g/t AgEq (125 g/t Ag, 0.21% Cu, 0.7% Pb, 1.7% Zn) |

| AL24-115 | 4.40 | 241 g/t AgEq (158 g/t Ag, 0.27% Cu, 0.9% Pb, 2.0% Zn) |

| AL24-117 | 36.65 | 328 g/t AgEq (211 g/t Ag, 0.40% Cu, 1.7% Pb, 3.1% Zn) |

| AL24-118 | 0.80 | 370 g/t AgEq (245 g/t Ag, 0.42% Cu, 1.4% Pb, 3.1% Zn) |

| AL24-119 | 1.00 | 125 g/t AgEq (82 g/t Ag, 0.14% Cu, 0.5% Pb, 1.0% Zn) |

| AL24-120 | 10.20 | 453 g/t AgEq (300 g/t Ag, 0.51% Cu, 2.0% Pb, 3.5% Zn) |

| AL24-120 | 8.60 | 321 g/t AgEq (212 g/t Ag, 0.36% Cu, 1.4% Pb, 2.8% Zn) |

| AL24-121 | 4.20 | 135 g/t AgEq (89 g/t Ag, 0.15% Cu, 0.6% Pb, 1.2% Zn) |

| AL24-122 | 4.60 | 129 g/t AgEq (85 g/t Ag, 0.14% Cu, 0.6% Pb, 1.1% Zn) |

| AL24-122 | 11.60 | 218 g/t AgEq (144 g/t Ag, 0.25% Cu, 1.0% Pb, 2.0% Zn) |

| AL24-123 | 4.50 | 300 g/t AgEq (198 g/t Ag, 0.34% Cu, 1.4% Pb, 2.7% Zn) |

| AL24-123 | 3.25 | 175 g/t AgEq (115 g/t Ag, 0.20% Cu, 0.8% Pb, 1.6% Zn) |

| AL24-125 | 4.80 | 255 g/t AgEq (168 g/t Ag, 0.29% Cu, 1.2% Pb, 2.3% Zn) |

| AL24-126 | 5.20 | 214 g/t AgEq (141 g/t Ag, 0.24% Cu, 1.0% Pb, 2.0% Zn) |

Note: Intercepts highlighted in gold (🟨) represent the top 2 highest-volume silver equivalent intervals, factoring both width and grade. These are key indicators of system strength.

A boulder discovered by MGG at the Alamos Silver Project in 2022 assaying 3,320 g/t Ag, 54.7 g/t Au, 25% Cu, 6.5% Pb, and 1.1% Zn.

Targeting 50+ Moz AgEq in Maiden Resource

MGG has drilled ~46,000m in 117 holes at Alamos and is targeting 50+ Moz AgEq in their maiden resource from only 2 of the 26 identified silver vein zones.

Permitting Advantage

Alamos is one of the few fully permitted silver projects in Mexico. Its 30-year Environmental Impact Statement (MIA) from SEMARNAT includes underground mining, infrastructure, and exploration. Local surface access rights were secured with unanimous ejido approval in 2024.

Community Impact

- 70%+ of hires are from surrounding communities

- Microloans and small business support programs

- Environmental rehabilitation efforts

Santa Marta: The Final Property J. David Lowell Wanted to Explore

The Santa Marta Project lies within the southeastern part of Oaxaca State, Mexico, and is on trend with major producing and past-producing mines such as the San Jose Mine, which produced over 30 million ounces of silver and ~250,000 oz of gold between 2011 and 2022.

Legendary geologist J. David Lowell, credited with discovering more copper than any geologist in world history, served as CEO of Lowell Copper when the company optioned Santa Marta from MGG in December 2013.

J. David Lowell believed that Santa Marta had strong potential for a multi-million-tonne VMS system rich in copper, zinc, and gold. When copper crashed by 40% shortly after, Lowell Copper chose to focus on Warintza instead.

Lowell Copper was later acquired, and Santa Marta remained the final property that J. David Lowell wanted to explore. MGG has since regained full control and recently filed for drill permits on a 3,000-meter program.

J. David Lowell’s Conviction in Minaurum

Lowell wasn’t just interested in Santa Marta—he was a major believer in Minaurum’s broader exploration vision. Lowell acquired a significant stake in the company, at one point holding 9,521,200 shares of MGG, representing over 10% ownership. These shares were purchased through a combination of private placements and open market transactions, further reinforcing the depth of Lowell’s conviction in both the team and the long-term potential of Minaurum’s projects.

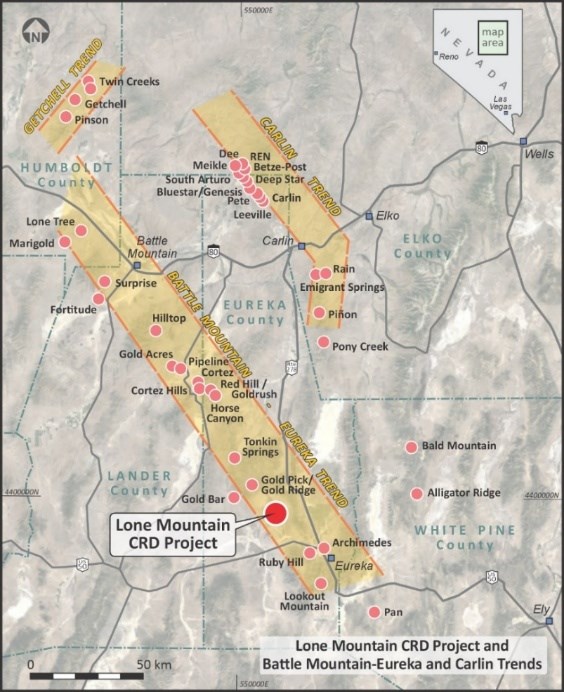

New Nevada Upside: Lone Mountain CRD Project

MGG’s brand-new acquisition of the Lone Mountain CRD Project adds a strategic CRD asset in Nevada’s Battle Mountain-Eureka Trend.

- Historical production: 5M lbs Zn, 650K lbs Pb, 4K lbs Ag

- 2018 historical inferred resource: 3.26Mt @ 7.57% Zn + 0.70% Pb

- Drilling Highlights: 118.87m @ 9.58% Zn, 24.7m @ 23.06% Zn

The Lone Mountain CRD Project is on trend with i-80 Gold’s most valuable Ruby Hill assets (including the FAD polymetallic CRD deposit) and McEwen Mining’s newly acquired Lookout Mountain, where McEwen has reported strong drilling results in recent months.

All historical drilling at the Lone Mountain CRD Project was near surface and targeted oxide zones. It has never been tested below 290m for sulfide mineralization. The system remains open and resembles deeper CRD systems like South32’s Taylor deposit at Hermosa in Arizona, which extends to depths of 1,200 meters.

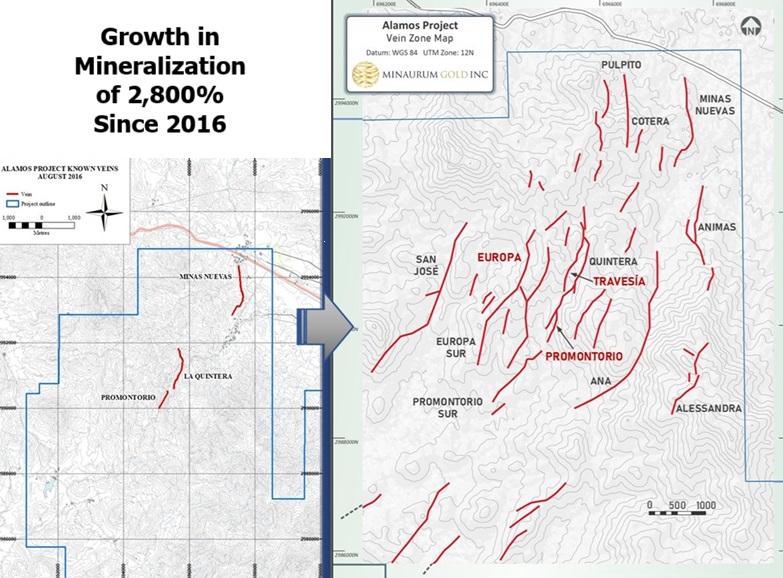

Rapid Growth Since 2016

Alamos’ mineralized footprint has grown by 2,800% since 2016—expanding from just 3 known vein zones to 26 mapped high-grade silver vein systems today.

- Over 46,000 meters of drilling completed across 117 drill holes as of mid-2025

- ~85% of the 37,928-hectare land package remains completely unexplored

- Major structural corridors identified linking Promontorio, Europa, and Quintera into a potentially unified district-scale system

- Strike length of mapped veins has tripled due to expanded geophysical and geochemical coverage

- Surface trenching and sampling continue to uncover new zones grading >1,000 g/t AgEq

What began as a small-scale historic silver camp is rapidly being redefined into one of Mexico’s most extensive and cohesive epithermal systems.

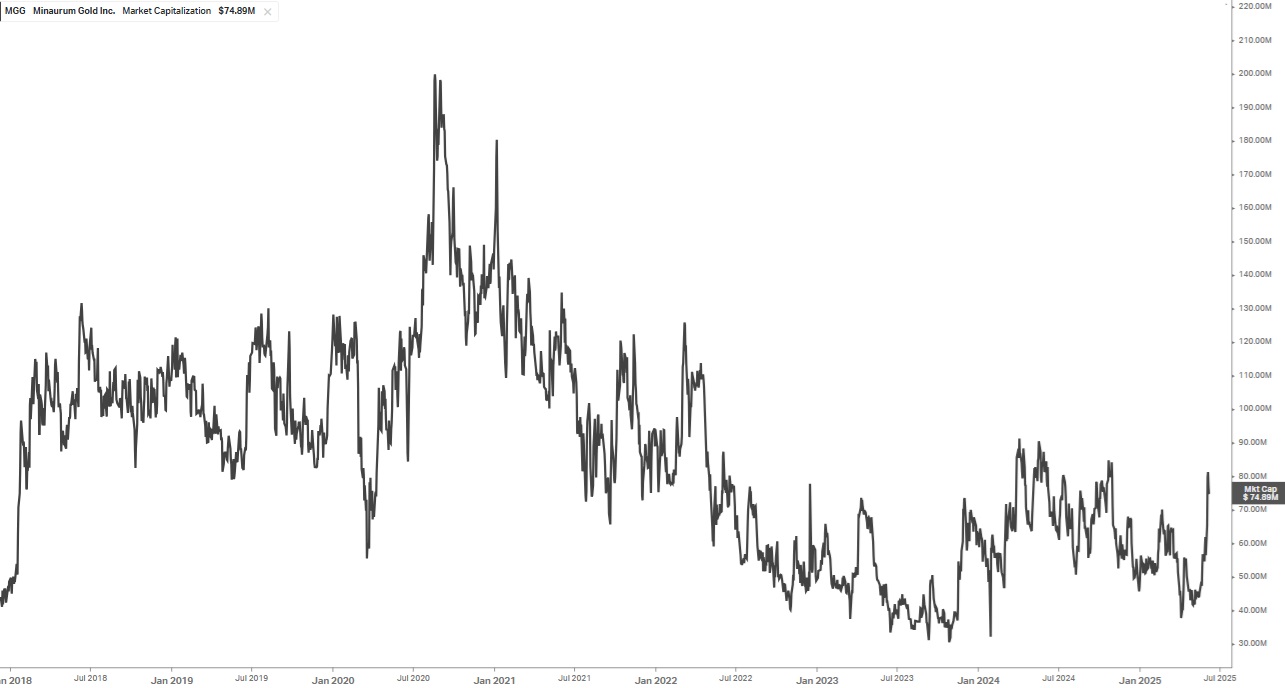

Today’s Valuation vs. Mid-2020 Peak Valuation

Despite recent discoveries of record silver equivalent grades, MGG’s market cap is only USD$74.89 million — well below its USD$199.79 million peak in 2020.

This disconnect comes as silver just settled at new 13+ year highs. From January 2018 through April 2022, MGG’s market cap was consistently higher than it is today for over 90% of the time — despite weaker silver prices throughout that period.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA is receiving compensation from MGG of US$100,000 cash for a twelve-month marketing contract and previously received US$60,000 cash for past marketing contracts which have since expired. This message is meant for informational and educational purposes only and does not provide investment advice.