Is Energym a Legit Energy Source for AI?

There’s a viral AI video of Sam Altman, Elon Musk, and Jeff Bezos talking about…

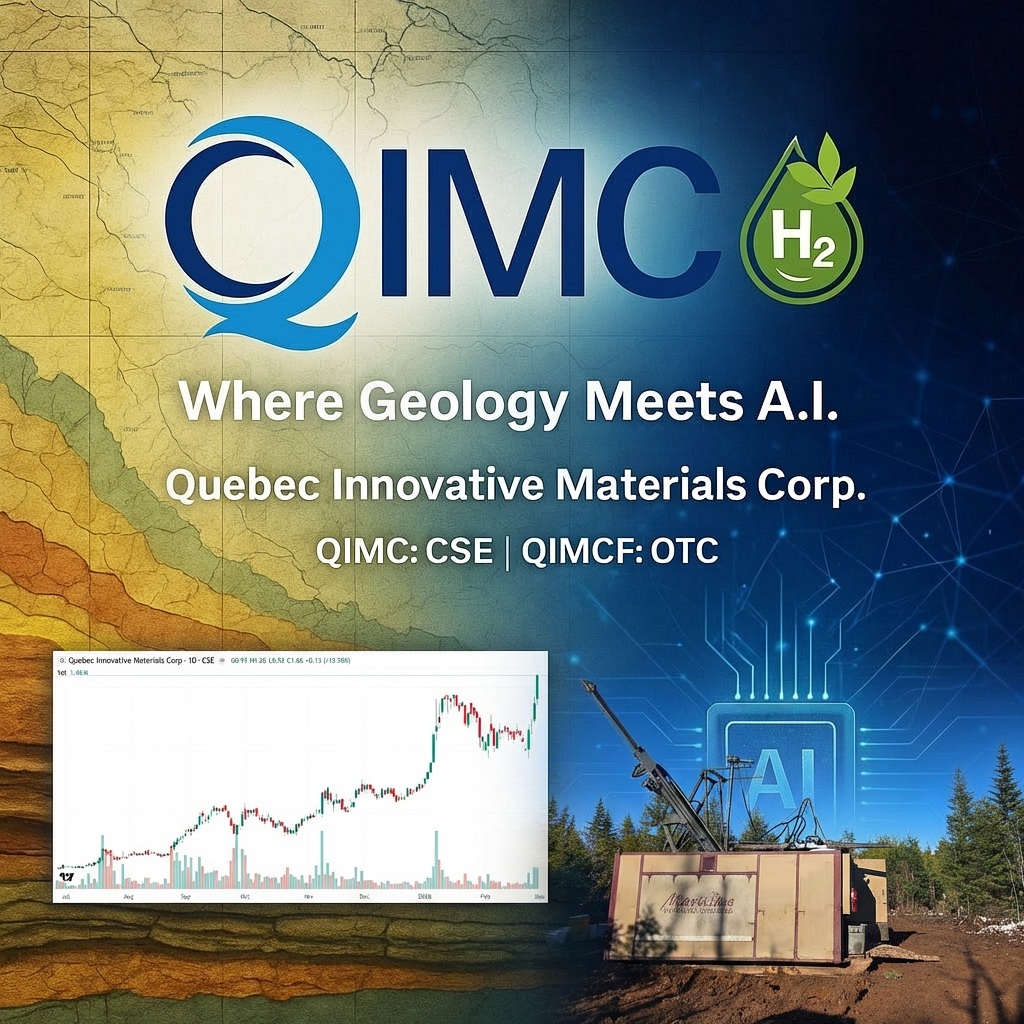

QIMC Hits NEW All-Time High After 13.98% Surge!

QI Materials (CSE: QIMC) surged by 13.98% today to a new all-time high of $1.06…

Urgent NIA Friday Morning Update: Huge Day Ahead

QI Materials (CSE: QIMC)'s drill hole DDH-26-01 has intersected a second hydrogen-associated structural zone at…

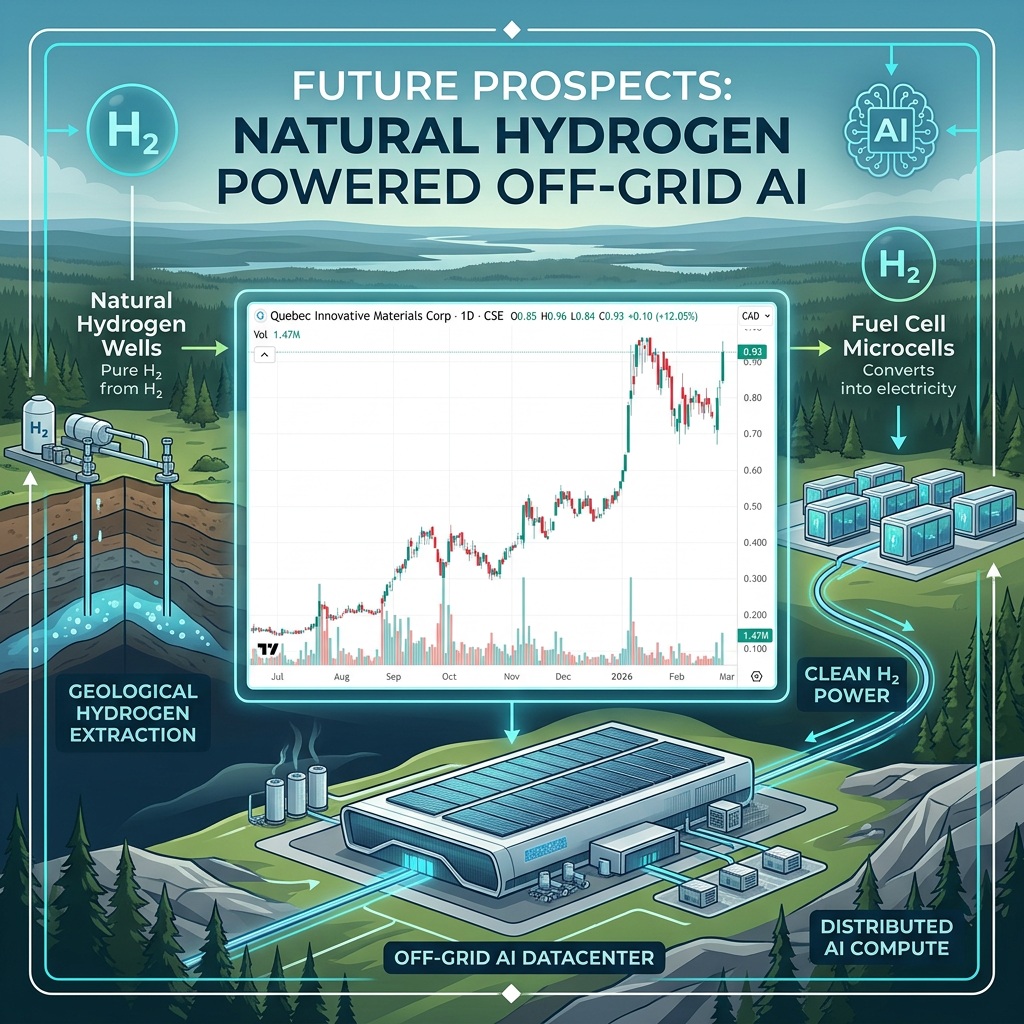

Is Natural Hydrogen the Real Boom Not Graphene?

QI Materials (CSE: QIMC) gained by 12.05% today to $0.93 per share and its chart…

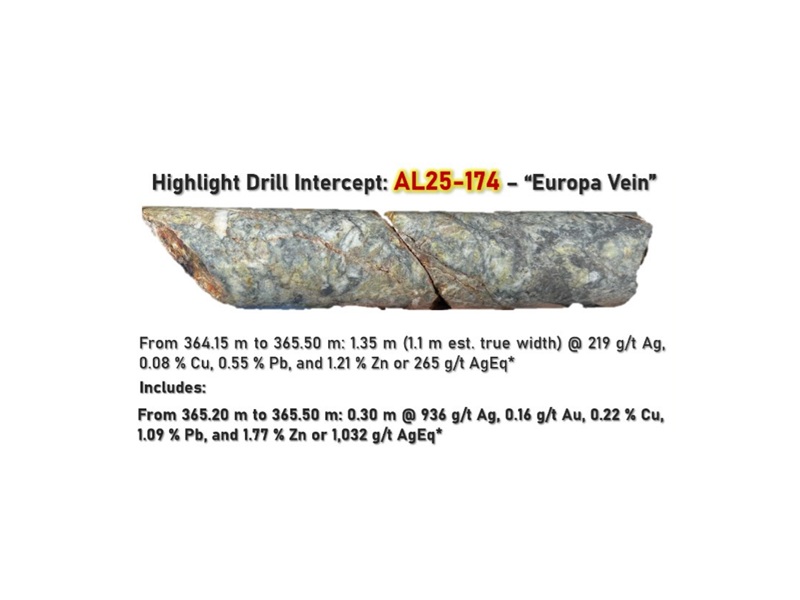

Minaurum Silver Hits 1,032 g/t AgEq and Adds 6th Rig

Minaurum Accelerates Exploration at Alamos Silver Project; Expands to Six Drill Rigs and Reports Additional…

QIMC Is Our Version of “Speculative” Stock

QI Materials (CSE: QIMC) is our version of a "speculative" stock similar to what Hydrograph…

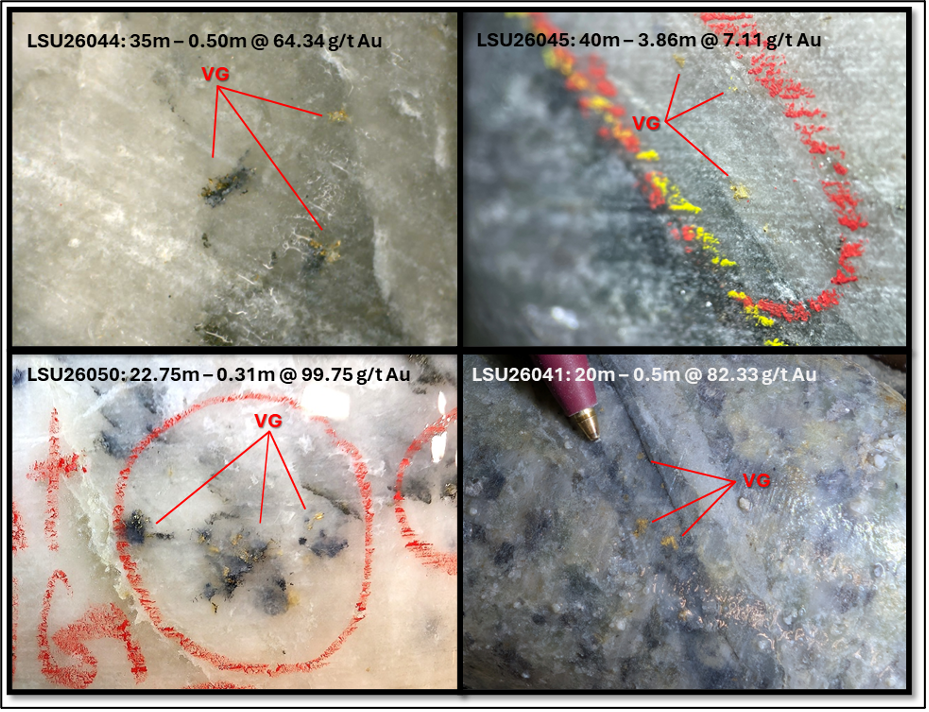

CTGO Strikes 60.22 g/t Gold Over 5.92 meters

NIA's President added 1,000 CTGO shares to his position last week. This is the most…

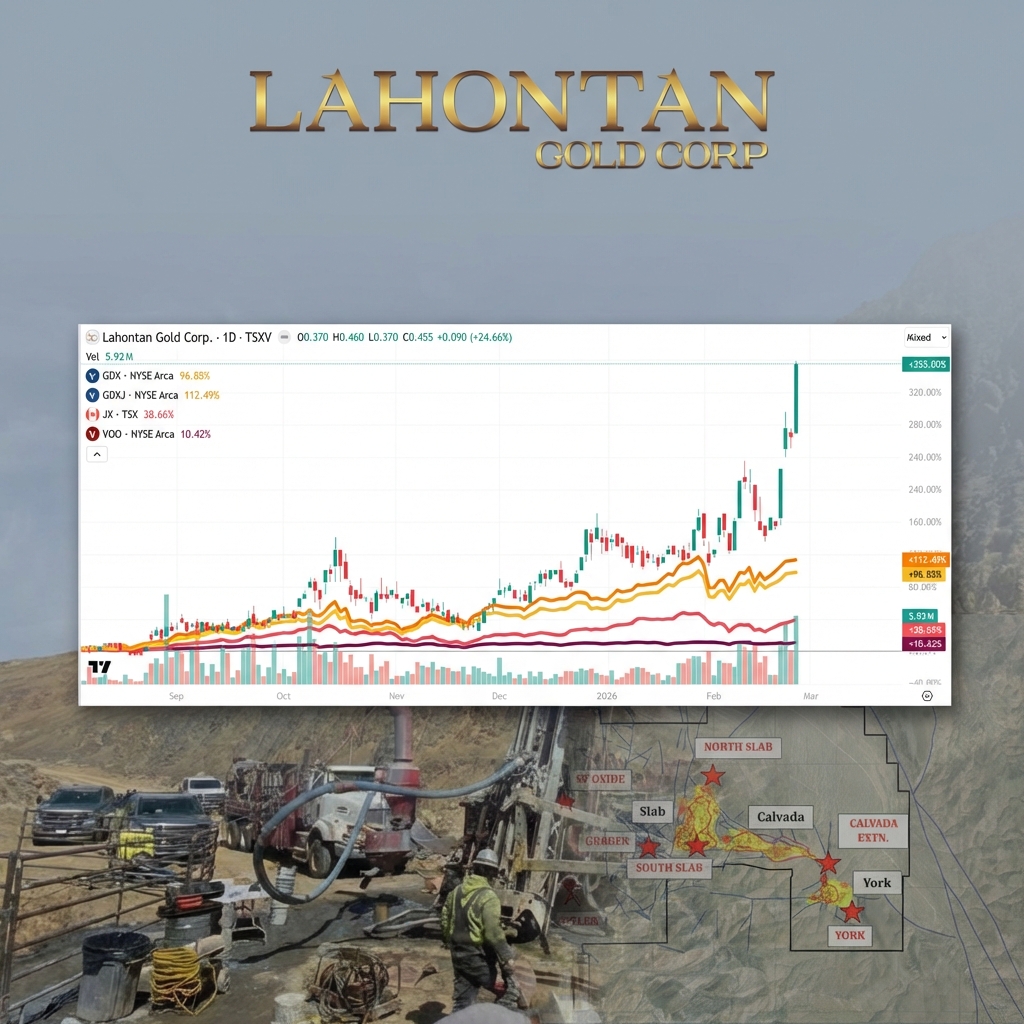

Lahontan Gold Gains 24.66% to New All-Time High of $0.455!

On the morning of February 3rd with Lahontan Gold (TSXV: LG) at $0.225 per share,…

Trio-Tech (TRT) Among Fastest Growing Companies in World

Yesterday afternoon, NIA sent out an alert saying, "Aehr Test Systems (AEHR) has just hit…

A 2+ Million Oz Gold Story for Under $60M

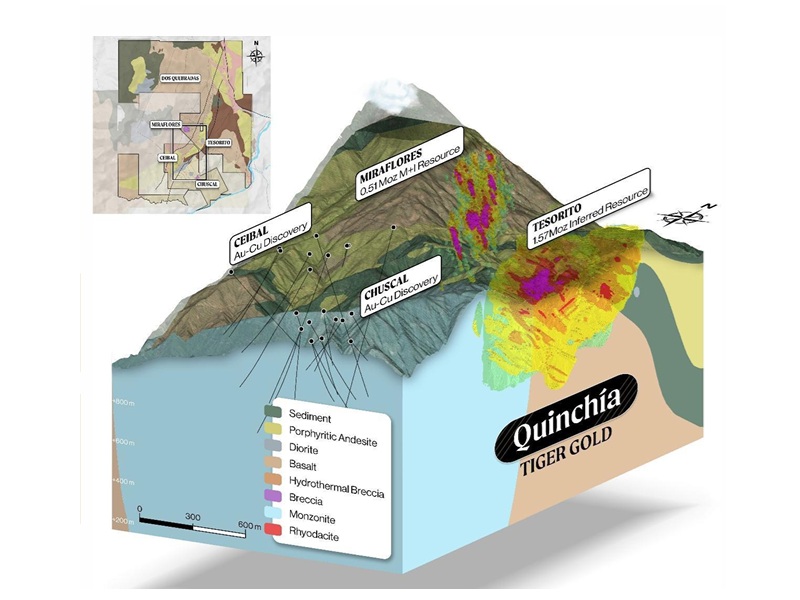

Tiger Gold (TSXV: TIGR) is advancing its flagship Quinchía Gold Project in Colombia's prolific Mid-Cauca…