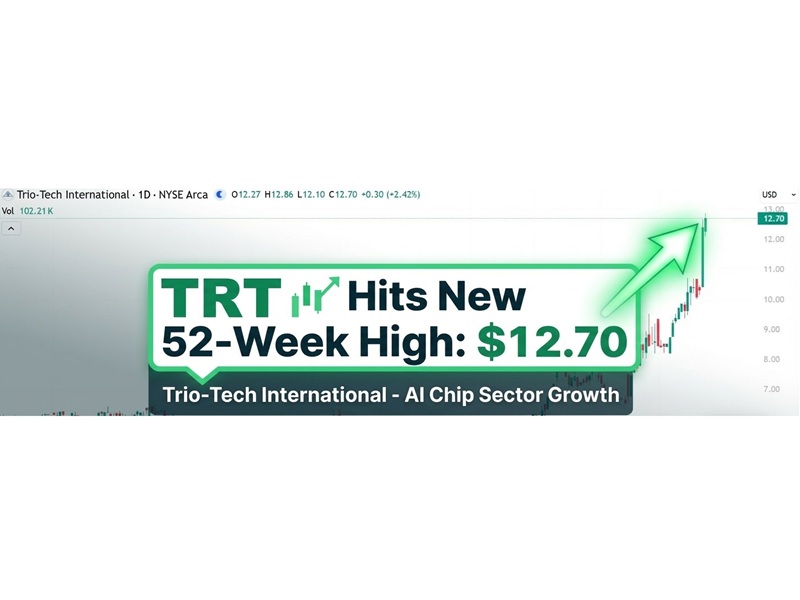

NIA Announces #2 Favorite Overall Stock Suggestion for 2026

NIA Announces Trio-Tech International (NYSE American: TRT) as Its #2 Favorite Overall Stock Suggestion for 2026 at $6.00 Per Share

Trio-Tech International (TRT) is a California-based semiconductor testing and equipment company with deep operational roots across Asia’s manufacturing hubs. We believe it represents one of the most undervalued beneficiaries of the AMD–OpenAI GPU build-out and the accelerating global shift toward AI, electric vehicles, and industrial automation.

Breaking Catalyst

AMD and OpenAI today announced a strategic chip-supply agreement under which AMD will deliver up to 6 gigawatts of AI GPUs, beginning with an initial 1 GW deployment in the second half of 2026. This marks AMD’s largest AI infrastructure expansion to date — and directly lifts demand for back-end testing and reliability systems manufactured and distributed by Trio-Tech International (TRT), one of AMD’s longest-standing partners.

Why We’re Excited About TRT

- Tier-One Customer Base: Past 10-Ks named AMD, Infineon, and NXP as top clients. Newer filings anonymize them as “Customer A/B/C,” still contributing ≈ 20 %, 17 %, and 10 % of revenue — indicating those relationships remain intact.

- Leverage to AI, EV, and Automation Growth:

- AI Data Center Power – testing systems essential for the new AMD–OpenAI GPU farms.

- EV Power Modules – Dynamic HTOL equipment for SiC/GaN devices built to AQG-324 automotive reliability standards.

- Industrial Electronics – segment revenue +70 % YoY in Q4 FY25, supplying automation and POS components across Asia.

- Financial Strength: $19.5 M cash vs. $25.9 M market cap → enterprise value ≈ $6.4 M on $36.5 M FY25 revenue (< 0.18× EV/Rev).

- Share Buyback: $1 M authorization underway — signal of confidence without dilution.

- Decades-long credibility: Trio-Tech has quietly supported AMD for over 20 years with no paid influencers or hype.

Key Metrics (at $6 per share)

| Metric | Value |

|---|---|

| Share Price (launch alert) | $6.00 |

| Shares Outstanding | 4,312,805 |

| Market Capitalization | $25.9 M |

| Cash & Deposits (FY25 end) | $19.5 M |

| Enterprise Value (EV) | ≈ $6.4 M |

| Revenue (FY25) | $36.47 M (+10 % YoY in Q4) |

| Operating Income (Q4 FY25) | $0.47 M (+30 % YoY) |

| EV / Revenue Multiple | 0.17× |

| Peer Comparison (AEHR) | 16.16× EV/Rev (~100× higher) |

Our Outlook

Trio-Tech is not a concept stock — it is a quietly profitable, cash-rich supplier embedded within Asia’s semiconductor supply chain. With AMD expanding its AI GPU footprint and the global adoption of SiC and GaN power devices accelerating, TRT’s products and test services sit squarely at the intersection of AI, EV, and industrial automation. If the market merely re-rates TRT toward a normal small-cap EV/Revenue multiple (1–2×), shares could justify a range of $15 – $25 without excess optimism.