From Explorer to Producer: Contango ORE (NYSE: CTGO) — Alaska’s Emerging Gold Powerhouse

Published: May 14, 2025 at 8:00 PM ET | CTGO Price at Publication: $12.85/share

Contango ORE (NYSE: CTGO) has successfully transitioned from a junior explorer to a producing gold company, achieving a significant milestone with the commencement of production at its 30%-owned Manh Choh mine in Alaska. Manh Choh produced gold at an average grade of 7.39 g/t in Q1 2025, making it one of the highest-grade producing gold mines in the world.

CTGO’s Manh Choh Joint Venture with Kinross Gold is now delivering substantial cash flows, positioning Contango for accelerated growth and value creation.

But Manh Choh is just the beginning.

Contango plans to reinvest this cash flow to unlock the immense potential of its wholly owned, ultra high-grade projects: Lucky Shot and Johnson Tract — two of the most exciting undeveloped gold assets in America.

With production ramping up, a healthy balance sheet, and development-ready assets under its control, Contango is one of the few junior miners with a clear, self-funded path to becoming a mid-tier gold producer — with a goal of producing 200,000 gold equivalent ounces annually within the next five years — all in one of the safest, most mining-friendly jurisdictions on earth: Alaska.

✅ Production Milestone Achieved in July 2024

- First Gold Pour: July 8, 2024, marked the first gold pour from Manh Choh, signaling the start of production.

- 2024 Production: Contango’s share amounted to 41,325 ounces of gold, surpassing initial guidance of 30,000–35,000 ounces.

- Cash Costs: Achieved 2024 cash costs of $1,209 per ounce, aligning with feasibility study projections.

🆕 Q1 2025 Financial & Operational Highlights

Contango ORE (NYSE: CTGO) has kicked off 2025 with transformative momentum, reporting $19.3 million in income from operations for Q1 — a major turnaround from a $2.9 million loss in Q1 2024.

- 17,382 oz of gold sold at an AISC of $1,374/oz, beating the full-year target of $1,625/oz

- On Track to Meet Full Year Production Guidance: Anticipates producing approximately 60,000 ounces of gold in 2025 from Manh Choh (Contango’s share).

- $24 million in cash distributions received from the Peak Gold JV in Q1

- $28.6 million in net operating cash flow achieved in Q1

- Contango repaid $13.8 million of its Credit Facility, reducing the outstanding principal balance by 26.5% to $38.3 million.

- Cash position of $35 million as of March 31, up sharply from $20.1 million as of December 31, 2024

- Zero capex spend in Q1 versus $15.5 million in Q1 2024 — transition to free cash flow well underway

- The Manh Choh trucking lawsuit was dismissed, de-risking long-term logistics

- Average realized spot gold price: $2,947/oz

🛠️ Strategic Growth Initiatives

- Johnson Tract Acquisition: Completed the acquisition of HighGold Mining Inc., adding the high-grade Johnson Tract project to its portfolio.

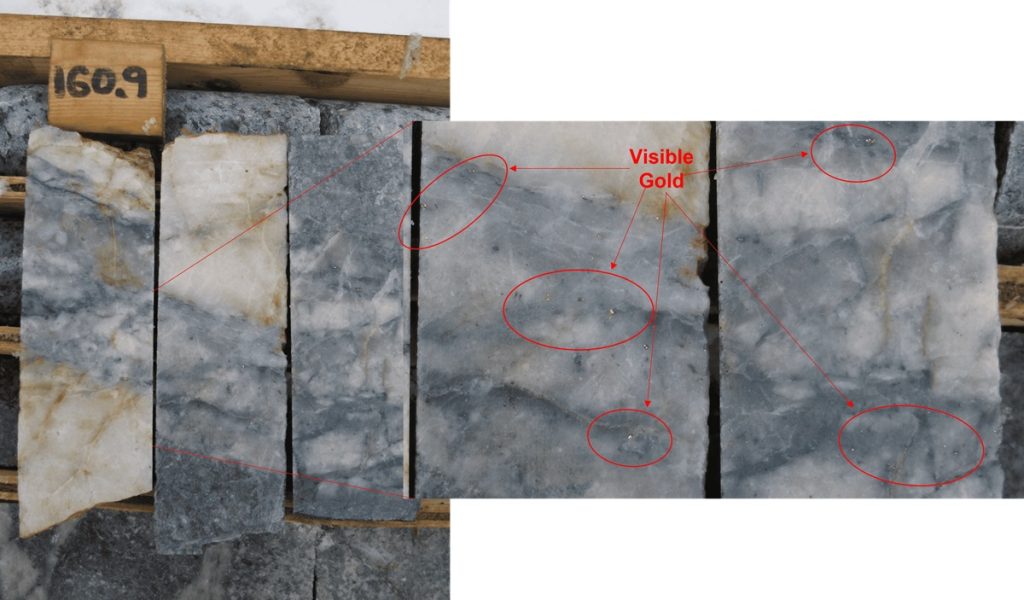

- Lucky Shot Project: Advancing the historic Lucky Shot mine, known for past production grades exceeding 40 g/t gold.

🗺️ Johnson Tract Overview

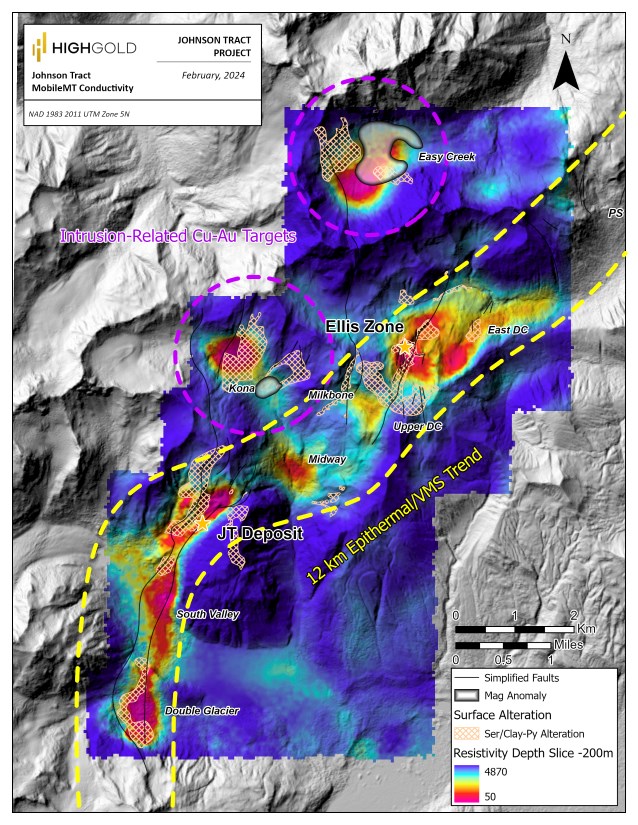

Contango ORE’s Johnson Tract Project in Southcentral Alaska represents a significant opportunity in the high-grade polymetallic mining sector.

- Location: Approximately 125 miles southwest of Anchorage, Alaska, near tidewater, facilitating potential direct shipping of ore.

- Ownership: Contango ORE holds the project through a lease agreement with Cook Inlet Region, Inc. (CIRI), an Alaska Native regional corporation.

- Property Size: The project encompasses 20,942 acres, including the high-grade JT Deposit and multiple exploration targets along a 12-kilometer mineralized corridor.

⛏️ Historical Drilling Results

The Johnson Tract deposit has consistently delivered some of the most spectacular multi-metal intercepts ever reported in North America. Over decades of exploration, drill results have confirmed a remarkably wide, high-grade system rich in gold and base metals — with multiple holes exceeding 100 meters of >10 g/t gold and strong zinc, copper, and silver credits. These intercepts establish Johnson Tract as one of the highest-grade undeveloped polymetallic gold systems in the United States.

- 108.6 m grading 10.4 g/t Au, 7.6% Zn, 0.7% Cu, 2.0% Pb and 8 g/t Ag (JT82-004 Original Discovery)

- 71.4 m grading 20.9 g/t Au, 9.8% Zn, 0.9% Cu, 1.6% Pb, and 9 g/t Ag (JT88-034)

- 137.7 m grading 11.3 g/t Au, 2.4% Zn, 0.5% Cu, 0.5% Pb, and 4 g/t Ag (JT93-067)

- 107.8 m grading 12.4 g/t Au, 7.1% Zn, 0.9% Cu, 1.6% Pb, and 9 g/t Ag (JT19-082)

- 75.1 m grading 10.0 g/t Au, 9.4% Zn, 0.6% Cu, 1.1% Pb, and 6 g/t Ag (JT19-090)

- 74.1 m grading 17.9 g/t Au, 7.3% Zn, 0.5% Cu, 1.3% Pb, and 7 g/t Ag (JT20-092)

- 56.6 m grading 19.3 g/t Au, 2.4% Zn, 0.5% Cu, 0.4% Pb, and 3.9 g/t Ag (JT21-125)

- 120.5 m grading 18.8 g/t Au, 3.9% Zn, 0.6% Cu, 0.9% Pb, and 6 g/t Ag (JT22-152)

📊 Johnson Tract Resource Overview

- Indicated Resource: 3.49 million tonnes grading 9.39 g/t gold equivalent (AuEq), for a total of approximately 1.05 million ounces AuEq

- Inferred Resource: 0.71 million tonnes grading 4.76 g/t AuEq, totaling approximately 108,000 ounces AuEq

- Metallurgy: Test work shows exceptional recoveries — with gold recoveries exceeding 97% and base metal recoveries ranging from 80% to 90%

- District-Scale Upside: In addition to the JT Deposit, the property spans a 12-kilometer mineralized trend hosting multiple untested targets — highlighting significant exploration upside

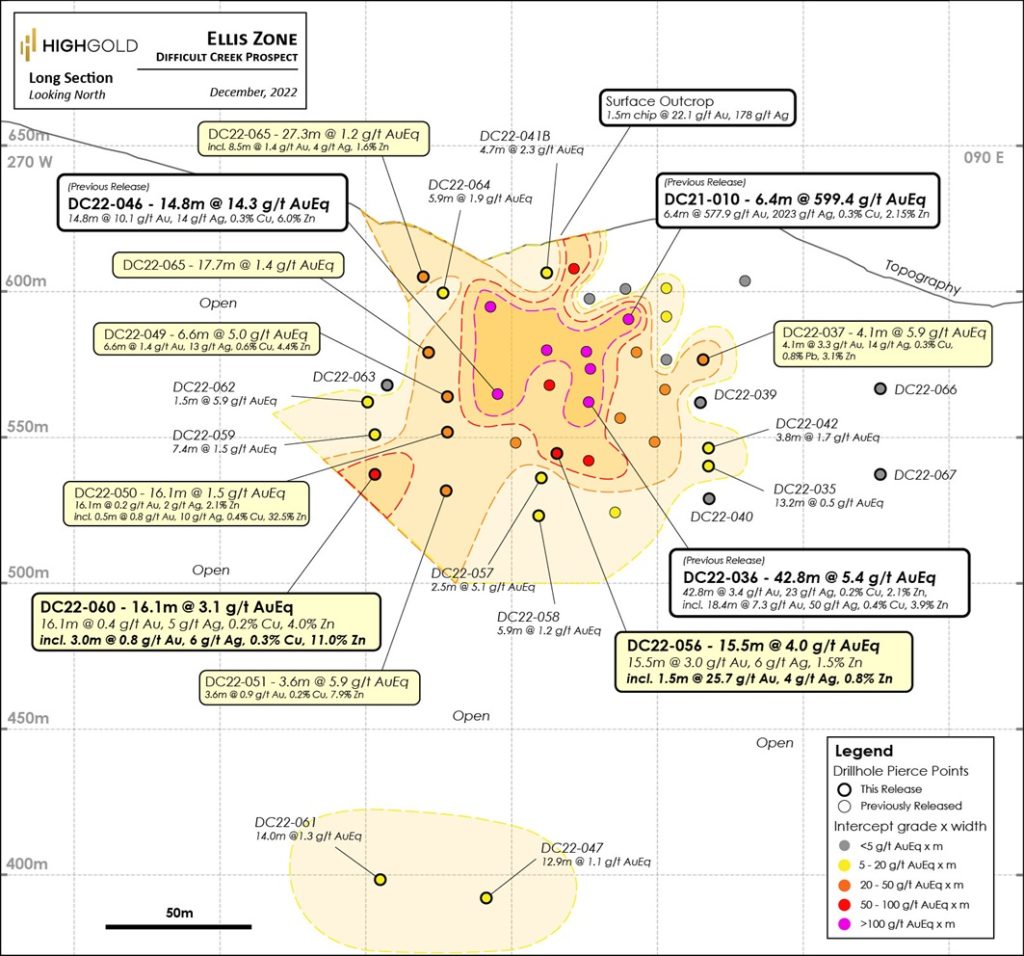

🧨 Ellis Zone Discovery – Bonanza-Grade Breakthrough at DC Prospect

The Ellis Zone is a major new gold-silver discovery within the larger DC Prospect, located approximately 4 km northeast of the main Johnson Tract deposit. This area hosts a 1.5 km by 3.0 km corridor of extensive gossan alteration and structurally controlled mineralization — mirroring the geological signature of the JT Deposit but extending over a significantly broader footprint.

Drilling in 2021 led to a breakthrough with the discovery of bonanza-grade mineralization at surface. Hole DC21-010 returned a staggering:

6.40 meters grading 577.9 g/t gold and 2,023 g/t silver

Subsequent drilling in 2022 and 2023 confirmed and expanded the Ellis Zone, now defined over 125 meters of strike and down to 225 meters vertically, with true thicknesses averaging 10–15 meters. Key intercepts include:

- 14.8 meters @ 14.3 g/t AuEq (DC22-046)

- 11.9 meters @ 21.7 g/t AuEq (DC22-043)

- 42.8 meters @ 5.4 g/t AuEq (DC22-036)

The Ellis Zone shares several hallmark features with the JT Deposit: high gold-equivalent grades, steep geometries, and stockwork veins rich in base metal sulfides, all hosted in anhydrite-altered dacitic volcaniclastic rocks.

🧮 Future Resource Growth Potential

The Ellis Zone — discovered in 2021 and expanded through 2023 — is not yet included in the Johnson Tract resource estimate. Yet it has already delivered multiple bonanza-grade intercepts, confirming mineralization over a strike length of 125 meters and to depths of 225 meters. For now, Ellis remains classified as an exploration target — but that may soon change.

Like all great gold systems, Johnson Tract holds hidden layers of value — and Ellis may be its most explosive. With ongoing drilling and a maiden resource in sight, this zone has the potential to unlock substantial new ounces and shift the entire narrative.

Once incorporated into a future NI 43-101 update, Ellis could transform Johnson Tract from a high-grade development story into a district-scale gold system — the kind of scale that attracts majors, rerates valuations, and redefines the opportunity.

In other words, investors today are getting the upside of Ellis — essentially for free.

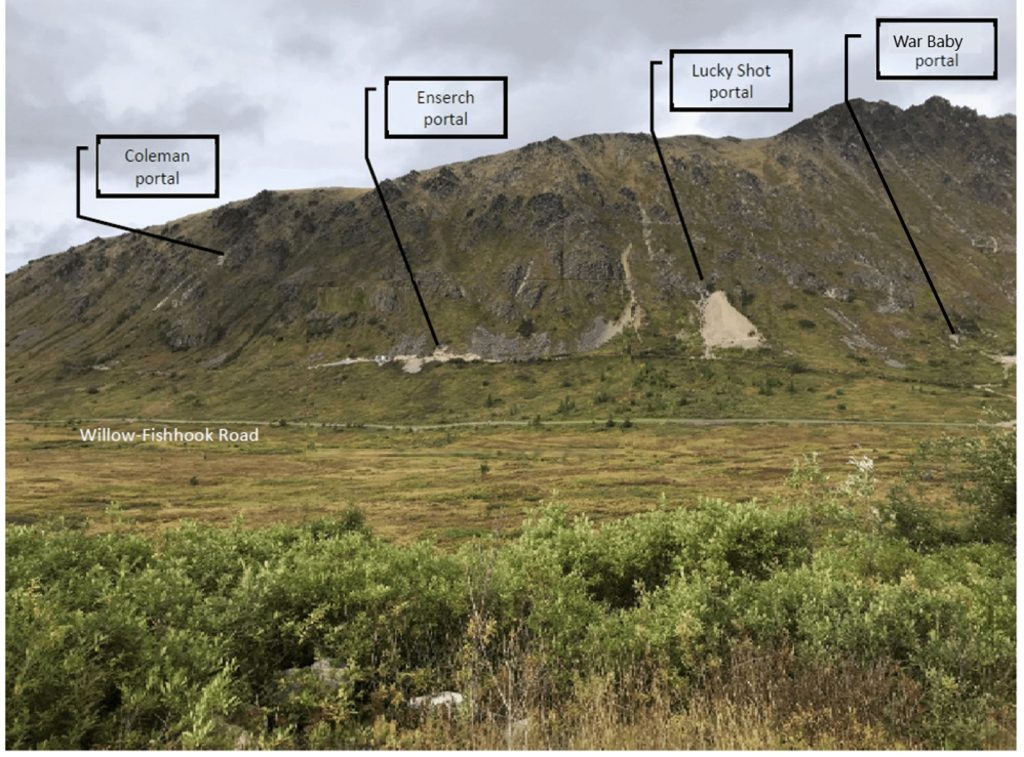

🎯 Lucky Shot Overview

Located 112 miles north of Anchorage in Alaska’s historic Willow Mining District, Lucky Shot is a past-producing high-grade gold project with existing infrastructure and a straightforward development path. The project is fully permitted for mining, positioning Contango to rapidly transition Lucky Shot into a near-term production asset.

Lucky Shot historically produced 252,000 ounces of gold at an average grade of ~40 g/t, making it one of the highest-grade gold mines in U.S. history. Today, Contango controls 8,590 acres across patented and State of Alaska claims and is advancing the project using a Direct Shipping Ore (DSO) model — reducing capex and environmental impact by transporting high-grade ore to existing processing facilities, similar to its strategy at Manh Choh.

📊 Lucky Shot Resource Estimate

- Indicated: 226,963 tonnes @ 14.5 g/t Au → 105,620 oz

- Inferred: 82,058 tonnes @ 9.5 g/t Au → 25,110 oz

- Deposits: Lucky Shot and Coleman zones

Ongoing exploration efforts aim to expand the resource base, enhancing the project’s value. Contango’s objective is to define 400,000–500,000 gold equivalent ounces and build a mine capable of producing 40,000–50,000 ounces annually, supporting its broader plan to become a 200,000 oz/year gold producer over the next five years.

👤 Leadership Spotlight: Rick Van Nieuwenhuyse – A Proven Mine Builder

At the helm of Contango ORE is Rick Van Nieuwenhuyse, a distinguished figure in the North American mining industry with over 40 years of experience. His career is marked by significant achievements in exploration, project development, and shareholder value creation, particularly within Alaska.

✅ Career Highlights:

- Founder & Former CEO of NovaGold Resources: Led the discovery and advancement of the Donlin Gold Project, one of the world’s largest undeveloped gold deposits.

- Founder & Former CEO of Trilogy Metals: Developed the Ambler Mining District, a billion-dollar copper-zinc project in partnership with South32.

- President & CEO of Contango ORE (since 2020): Transitioned the company from exploration to production, with the Manh Choh mine now generating cash flow, and advancing the high-grade Lucky Shot and Johnson Tract projects.

🔄 Recent Developments:

In April 2025, a significant shift occurred in the Alaskan gold mining landscape when John Paulson, a renowned billionaire investor, acquired a 40% stake in the Donlin Gold Project for $800 million, partnering with NovaGold, which increased its stake to 60% by investing an additional $200 million. This move underscores the growing investor confidence in Alaska’s gold mining potential—a region where Van Nieuwenhuyse has been a pioneer.

Van Nieuwenhuyse’s early work in establishing the Donlin Gold Project laid the foundation for its current valuation and attractiveness to major investors like Paulson. His strategic vision and expertise continue to drive Contango ORE’s growth, positioning the company to capitalize on Alaska’s rich mineral resources.

🎯 Strategic Vision:

Van Nieuwenhuyse’s leadership at Contango ORE reflects a consistent strategy:

- Identify high-grade, low-capex opportunities

- Forge strategic partnerships (e.g., with Kinross Gold at Manh Choh)

- Advance assets through permitting, development, and production

- Deliver long-term shareholder value while minimizing dilution

With his deep understanding of Alaska’s regulatory environment and a track record of developing multi-billion-dollar projects, Rick Van Nieuwenhuyse provides Contango ORE with a significant competitive advantage in the mining sector.

Contango ORE Puts Alaska’s Strategic Metals on the National Agenda

In April 2025, Contango ORE President & CEO Rick Van Nieuwenhuyse traveled to Washington, D.C. to participate in Alaska On The Hill, a key annual event where Alaskan business leaders meet with federal policymakers to promote the state’s economic priorities.

During the visit, Van Nieuwenhuyse met with U.S. lawmakers and regulatory officials to discuss:

- The strategic importance of Alaska’s mineral resources

- The critical metal profile of Johnson Tract (gold, silver, copper, zinc)

- Contango’s production success at Manh Choh and its role in boosting U.S.-sourced gold supply

- Federal support for infrastructure and permitting efficiencies in remote regions of Alaska

This engagement reinforces Contango’s position as not only a premier gold developer but also a responsible corporate citizen committed to transparency, collaboration, and long-term sustainable development in one of America’s most resource-rich states.

“Alaska plays a vital role in securing America’s mineral independence — and Contango ORE is proud to be leading that effort.”

— Rick Van Nieuwenhuyse, CEO

🔚 The Path Forward: Three Projects, One Vision

Contango ORE (NYSE: CTGO) has moved beyond speculation — it’s executing.

- Manh Choh is now fully permitted and producing gold, generating massive cash flow with projected 2025 output of 60,000 oz (Contango’s share) and life-of-mine AISC of just $1,400/oz.

- Lucky Shot is also fully permitted for mining and stands ready to deliver high-margin ounces from one of North America’s highest-grade undeveloped gold deposits. CTGO plans to expand its 110,000 oz gold equivalent indicated resource to 400,000–500,000 gold equivalent oz, with initial annual production of 30,000–40,000 gold equivalent oz targeted.

- Johnson Tract has emerged as a future company-maker, with a 1.1 million oz gold equivalent indicated resource at 9.4 g/t AuEq, robust economics (After Tax NPV 5% of US$224.5M at $2,200 per oz) with one-year payback, and permitting secured in August 2024 for critical road access. A feasibility study and construction decision are expected by 2028/2029.

With one mine producing, two world-class projects advancing, and a management team with a track record of billion-dollar discoveries — Contango is building the next great American gold company.

This is not just a junior with a dream. It’s a fully permitted, revenue-generating U.S. gold developer with a pipeline of grade, scale, and growth — and it’s trading at a fraction of its potential value.

Now producing. Now funded. Now positioned.

Contango ORE (NYSE: CTGO) — the next great U.S.-based multi-asset gold producer.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA’s President has purchased 5,000 shares of CTGO in the open market and intends to buy more shares. NIA has received compensation from CTGO of US$80,000 cash for a ten-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.